Your project budgets for next year depend on accurate steel price forecasts. For a critical component like L-shaped steel, used in countless frames and brackets, getting this wrong can turn a profitable project into a loss. Understanding the macro and micro drivers is no longer optional—it’s essential for survival.

The future market for marine L-shaped steel will be shaped by volatile but structurally elevated raw material costs, strong demand from shipbuilding and offshore wind, a shift towards higher-strength grades, and increasing regionalization of supply chains. Prices will remain cyclical but trend higher over the medium term due to green transition costs and sustained demand in key sectors.

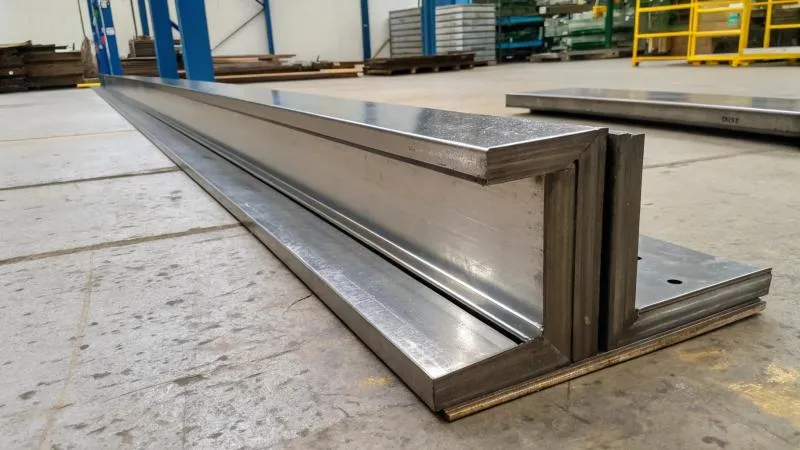

L-shaped steel is not a standalone commodity. Its fate is tied to the health of the entire marine construction industry and the global steel market’s dynamics. Let’s analyze the competing forces that will determine its availability and price in the coming years.

Is the price of steel rising?

You look at your latest quote and compare it to last year’s. The number is higher. But is this a temporary spike or the start of a long-term trend? For marine L-shaped steel, the answer involves more than just the headline price of hot-rolled coil.

Yes, the underlying trend for steel prices is rising over the medium to long term, driven by structural increases in the cost of raw materials (iron ore, coking coal), energy, and carbon compliance. However, prices will remain highly volatile, with sharp corrections possible during periods of weak demand. For marine L-shaped steel, additional premiums for certification, processing, and logistics add further upward pressure.

Saying "prices are rising" is an oversimplification. It’s more accurate to say the cost floor is rising. The days of consistently cheap steel are over due to fundamental changes in the industry’s economics. Let’s examine the structural drivers pushing that floor higher.

The Structural Uplift: Why the Cheap Steel Era is Ending

Short-term fluctuations will always occur, but several irreversible forces are resetting the baseline cost of producing steel, and by extension, marine sections.

1. The Green Transition Cost1:

This is the most significant new factor. Decarbonizing steelmaking is capital-intensive.

- Carbon Pricing: Emissions trading schemes (EU ETS, China’s national ETS) add a direct cost per ton of CO2 emitted. Blast furnace steel has a high carbon footprint.

- Technology Investment: Mills are investing billions in Electric Arc Furnaces (EAF)2 powered by renewable energy, Carbon Capture, Utilization and Storage (CCUS)3, and hydrogen-based direct reduction. These technologies have higher capital and operational costs that will be reflected in the price of "green" or low-carbon steel.

- Implication: Even if demand falls, the cost to produce steel sustainably will be higher. Buyers may pay a "green premium" for certified low-carbon steel.

2. Elevated and Volatile Input Costs:

- Iron Ore & Met Coal4: Geopolitical tensions and supply concentration keep these prices volatile and structurally higher than a decade ago.

- Energy: The shift away from cheap fossil fuels increases electricity and natural gas costs for mills, especially in Europe.

3. Geopolitical Fragmentation & Supply Chain Re-risking:

- Tariffs and Trade Barriers5: Policies like the US Section 232 tariffs and EU CBAM (Carbon Border Adjustment Mechanism) disrupt traditional trade flows, creating regional price disparities and adding complexity.

- Onshoring/Nearshoring: Some governments incentivize domestic steel production. This can reduce dependence on imports but often at a higher cost due to less competitive scale.

Impact on Marine L-Shaped Steel:

For a product like L-angle, these forces translate into:

- A higher base price for the raw steel billet.

- Potential extra costs if mills pass on carbon compliance fees.

- Increased logistics complexity and cost if sourcing patterns shift due to trade policies.

Price Outlook Summary:

| Time Frame | Price Driver | Likely Impact on Marine L-Steel |

|---|---|---|

| Short-Term (1-12 months) | Cyclical demand (shipbuilding orders), Chinese economic policy, scrap prices. | High volatility. Possible sharp corrections if demand slows. |

| Medium-Term (2-5 years) | Structural green transition costs, sustained demand from offshore wind and naval projects. | Trend is upward. Higher cost floor with cyclical peaks and troughs. |

| Long-Term (5+ years) | Widespread adoption of green steel tech, potential new supply from Africa/India. | Prices may stabilize at a higher plateau defined by the cost of green production. |

Procurement strategy must adapt. Hedging, long-term contracts with price adjustment clauses, and partnerships with efficient suppliers become more critical than ever.

Why are steel prices falling?

You see a headline: "Steel Prices Crash." This creates hope for lower project costs. But a price drop can be a trap if it’s driven by collapsing demand that also threatens your own project pipeline. Understanding why prices fall tells you if it’s a buying opportunity or a warning sign.

Steel prices fall primarily due to weaker than expected demand1 (e.g., a slowdown in construction or manufacturing), excess supply2 (mills producing too much despite weak demand), a sharp drop in the cost of key raw materials3 (iron ore, scrap), or aggressive export pricing4 from a major producer like China to clear domestic inventory. These are typically cyclical, short-to-medium term corrections within a longer-term structural uptrend.

A price drop is a symptom. The underlying cause dictates how long it will last and what it means for the health of the marine sector. Let’s diagnose the different types of price declines.

Diagnosing the Downturn: Cyclical vs. Structural Drops

Not all price falls are equal. Some are healthy corrections; others signal deeper problems.

Type 1: Demand-Driven Decline5 (The Most Common)

- Cause: A macroeconomic slowdown reduces orders from major steel-consuming sectors (real estate, automotive, appliance manufacturing). Shipbuilding orderbooks thin out.

- Characteristics: Broad-based decline across most steel products. Mills cut production to match lower demand. Inventory builds at service centers.

- Implication for Marine L-Steel: This is a mixed signal. Lower input costs are good, but if the cause is a global recession, your own shipyard may face fewer new orders. It’s a buying opportunity only if your project pipeline remains strong.

Type 2: Supply-Driven / Competitive Price War6

- Cause: A major producer (often China) maintains high output levels despite soft demand to maintain cash flow and market share, flooding the market.

- Characteristics: Prices fall aggressively, sometimes below the cost of production for higher-cost mills. Export prices from the aggressive producer drop fastest.

- Implication for Marine L-Steel: This can be a good short-term buying window. However, be wary of quality. In a price war, some suppliers may source from lower-tier mills or cut corners on certification to meet the low price. Due diligence is crucial.

Type 3: Raw Material Cost Collapse

- Cause: A significant, sustained drop in iron ore or scrap metal prices.

- Characteristics: The cost push from raw materials eases. Mills’ profit margins may initially expand, but competition usually forces them to pass on some savings.

- Implication for Marine L-Steel: A genuine cost reduction opportunity. The fundamental demand for steel might still be healthy. This is an ideal time to lock in contracts for future requirements.

How to Respond as a Buyer of Marine Sections:

| If Prices Are Falling Because… | Your Risk | Your Potential Action |

|---|---|---|

| …of weak global demand (recession). | Your own future projects may be delayed or canceled. | Be cautious. Use spot buying for immediate needs, avoid long-term commitments. |

| …of a Chinese supply glut (price war). | Quality risk from desperate suppliers. | Opportunity, but verify. Secure quotes from trusted suppliers who can explain the source of the low cost. Insist on standard MTCs and inspection. |

| …of lower iron ore/scrap costs. | Minimal, if demand is stable. | Strategic opportunity. Negotiate longer-term fixed-price or formula-based contracts to lock in the lower cost base for future projects. |

A falling price should trigger questions, not just celebration. It’s a key moment to assess the market’s health and your supplier’s stability.

Are steel building prices coming down?

You’re pricing a new warehouse or port facility. The quote includes both the structural steel (beams, columns) and the cladding. "Steel building prices1" are a composite of material, fabrication, and erection costs. Their trend indirectly affects the marine sector by competing for mill capacity and fabrication labor.

Steel building prices1 may experience short-term declines if raw steel prices fall and fabrication capacity is available. However, long-term trends like high energy costs, skilled labor shortages, and demand from competing sectors (like shipbuilding and infrastructure) create upward pressure. For marine projects using similar sections (like L-angle for brackets), they face the same material cost dynamics but different demand drivers.

The construction steel market is a close cousin to the marine steel market. They often draw from the same mills for sections like wide-flange beams and angles. Understanding their price dynamics helps you anticipate broader market pressures.

The Link Between Building Steel and Marine Steel Markets

While the end use is different, the supply chains overlap, especially for common structural sections.

Shared Drivers:

- Raw Material Cost2: Both use steel from the same blast furnaces or EAFs. The price of HRC and billets affects both.

- Mill Capacity3: If mills are running at full capacity to meet shipbuilding plate orders, they may have less capacity for rolling structural sections like beams, tightening supply and raising prices for all users.

- Logistics & Energy: Shared challenges in shipping and energy costs.

Diverging Drivers:

- Demand Cycles4: Building construction is heavily tied to interest rates and real estate cycles. Shipbuilding is tied to global trade, energy prices, and environmental regulations. These cycles do not always sync.

- Fabrication Labor5: A boom in offshore wind foundation fabrication can drain the pool of skilled welders and fitters, driving up labor costs for both shipyards and building fabricators.

- Product Mix: Shipbuilding uses vast amounts of plate and specialized sections (bulb flats). Building construction uses more standard I-beams, H-beams, and hollow sections.

The "Canary in the Coal Mine" Effect:

Often, a slowdown in building construction (leading to lower building steel prices) can be an early indicator of a broader economic slowdown that may eventually reach the marine sector with a lag of 6-12 months.

Strategic Implication for Marine Buyers:

- Monitor Building Steel Indices: Prices for common structural shapes can give you insight into overall steel market tightness and fabrication shop workload.

- Understand Competition for Resources: When you hear about a "megaproject" like a large bridge or airport, recognize that it will consume mill capacity and skilled labor, potentially constraining supply for your marine L-steel orders.

- Differentiate Your Needs: Marine-grade L-steel6 (e.g., AH36 angle) commands a premium over standard ASTM A36 angle used in buildings due to certification and testing. Ensure your suppliers and quotes clearly specify the marine grade to avoid confusion and ensure you’re comparing like-for-like.

In summary, steel building prices offer a useful, but not perfect, barometer for the broader structural steel environment in which marine procurement operates.

Will the steel sector go up?

You’re making a five-year investment in shipyard capacity. You need to know if the steel sector—your primary input—will be a headwind or a tailwind. The sector’s health depends on more than just price; it’s about profitability, innovation, and strategic direction.

The global steel sector’s overall trajectory is upward in terms of strategic importance and value, but it will be a turbulent ascent. It faces rising costs from decarbonization1 but will benefit from sustained demand in green energy (wind, hydrogen), infrastructure, and defense. Profitability will diverge between leaders in green technology and high-cost, legacy producers. The sector is not dying; it is transforming.

Asking if the sector will "go up" is like asking if the automotive sector went up after the shift to electric vehicles. It changed dramatically. The steel sector is undergoing a similar existential transformation, with winners and losers.

The Two-Tier Future: Green Giants vs. Stranded Assets

The sector will bifurcate. Success will be defined by the ability to adapt to the dual challenges of decarbonization1 and changing demand patterns.

Tier 1: The Future-Proofed Leaders

These companies will thrive. They are characterized by:

- Investment in Green Steel2: Early movers in hydrogen-DRI, EAF with renewable power, and CCUS.

- High-Value Product Mix: Focus on advanced grades for automotive, renewable energy, and specialized marine/offshore applications.

- Vertical Integration & Recycling: Control over scrap supply and efficient recycling loops.

- Digitalization3: Use of AI and data analytics for efficiency and customer service.

- Geographic Advantage: Located in regions with supportive policy, clean energy, and strong demand.

Tier 2: The Challenged Incumbents

These face significant headwinds:

- Legacy, Carbon-Intensive Assets: Reliant on old blast furnaces with high emissions.

- Commodity Focus: Produce bulk, low-value products susceptible to price wars.

- High Operational Costs: In regions with expensive energy and labor without corresponding productivity.

- Vulnerable to Carbon Costs: Exposed to carbon border taxes and loss of market share.

Demand Tailwinds for the Sector:

Despite challenges, several mega-trends will support long-term demand for high-quality steel:

- Green Energy Infrastructure4: Offshore wind farms require massive amounts of steel for monopiles, towers, and substations.

- Global Naval Expansion: Geopolitical tensions are driving increased naval shipbuilding worldwide.

- Sustainable Transportation: While lighter, electric vehicles still use significant advanced steel.

- Urbanization & Infrastructure5: In developing economies, continued building and public works.

Implication for Marine L-Shaped Steel Buyers:

- Supplier Selection6 is Critical: Partner with suppliers connected to Tier 1 mills. They will have more stable access to quality material and be better positioned for the future.

- Expect a "Green Premium": Be prepared for markets to value and price steel differently based on its carbon footprint. This may become a contract requirement.

- Innovation in Products: The mills that survive will offer new, improved grades. Be open to adopting higher-strength or more weldable versions of L-steel that can reduce your total project cost through weight savings or faster fabrication.

The sector is not going away; it is entering a more complex, value-differentiated era. For a buyer, this means greater need for expertise and partnership to navigate the new landscape successfully.

Conclusion

The marine L-shaped steel market faces a future of higher structural costs and volatile prices, driven by green transition investments and competing demand, requiring strategic procurement and partnerships with resilient suppliers.

-

Understanding decarbonization’s role is crucial for predicting steel sector trends and investment opportunities. ↩ ↩ ↩ ↩ ↩ ↩

-

Explore how green steel investments are transforming the industry and creating sustainable growth opportunities. ↩ ↩ ↩ ↩

-

Learn how digital tools are enhancing efficiency and competitiveness in the steel sector. ↩ ↩ ↩ ↩

-

Discover how green energy projects are driving steel demand and shaping market dynamics. ↩ ↩ ↩ ↩

-

Understand the relationship between urbanization trends and steel demand in developing economies. ↩ ↩ ↩ ↩

-

Find out why choosing the right suppliers is essential for securing quality materials and future success. ↩ ↩ ↩