Budgeting for your next shipbuilding project is hard. Steel prices change every week. You need reliable data and clear trends to make smart purchasing decisions and protect your margins.

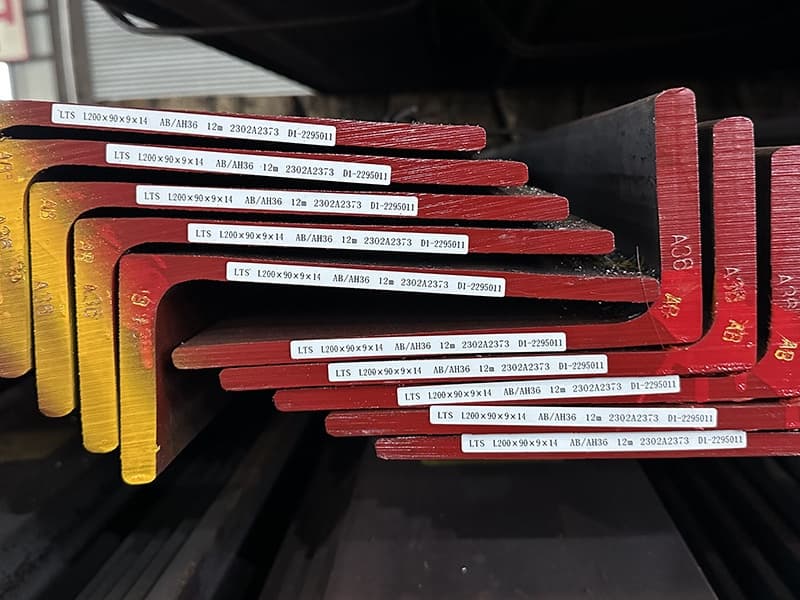

This analysis examines the price trends and export dynamics for marine L-shaped steel (angle bars). Prices are influenced by raw material costs, Chinese industrial policy, global shipyard demand, and freight rates. Key exporting hubs like Shandong, China, supply major markets in Southeast Asia and the Middle East, with prices expected to see moderate volatility through 2025.

Every month, I talk to buyers like the manager from Gulf Metal Solutions. Their main question is always about timing: "Should we buy now or wait?" There is no crystal ball, but understanding the key drivers can give you a powerful advantage. Let’s explore the factors that move the market.

Will steel prices go up or down?

You have a project starting in six months. You need to lock in costs. Guessing wrong on steel prices can wipe out your profit. So, what is the direction?

Steel prices will likely experience both ups and downs in the near term. In the short term (3-6 months), prices may see downward pressure due to high Chinese inventory and moderate demand. In the medium term (6-18 months), prices could rise if global manufacturing recovers and raw material costs increase. It is a volatile, cyclical market.

Saying "prices will fluctuate" is easy. The real value is in understanding why they move. Let’s look at the forces pushing prices up and pulling them down.

The Balancing Act: Bullish vs. Bearish Factors

The steel price is a tug-of-war between positive (bullish) and negative (bearish) factors. No single factor decides everything.

| Bullish Factors (Pushing Prices UP) | Bearish Factors (Pulling Prices DOWN) |

|---|---|

| 1. Rising Raw Material Costs: Increase in iron ore, coking coal, or scrap steel prices. | 1. High Production & Inventory: Chinese mills producing at high rates, leading to oversupply in the market. |

| 2. Strong Demand: Increase in shipbuilding orders, infrastructure projects, and manufacturing activity in key markets. | 2. Weak Demand: Slowdown in the global construction sector or delayed infrastructure investments. |

| 3. Policy Support: Chinese government stimulus for the property or manufacturing sector. | 3. Trade Barriers: New tariffs or trade restrictions that disrupt normal export flows. |

| 4. Supply Disruptions: Environmental shutdowns at mills or logistics problems at ports. | 4. Lower Energy Costs: Falling prices for electricity and natural gas, reducing production costs. |

| 5. Currency Effects: A weakening Chinese Yuan (CNY) makes exports cheaper, boosting foreign demand. | 5. Strong Chinese Yuan: Makes Chinese steel more expensive for international buyers, reducing demand. |

Right now, in mid-2024, we see a mix. Raw material costs (iron ore) are relatively stable. But demand from the global shipbuilding sector remains strong, which supports prices for marine-grade steel specifically. However, general construction demand in China is soft, which keeps a lid on overall price increases.

What This Means for Marine L-Shaped Steel

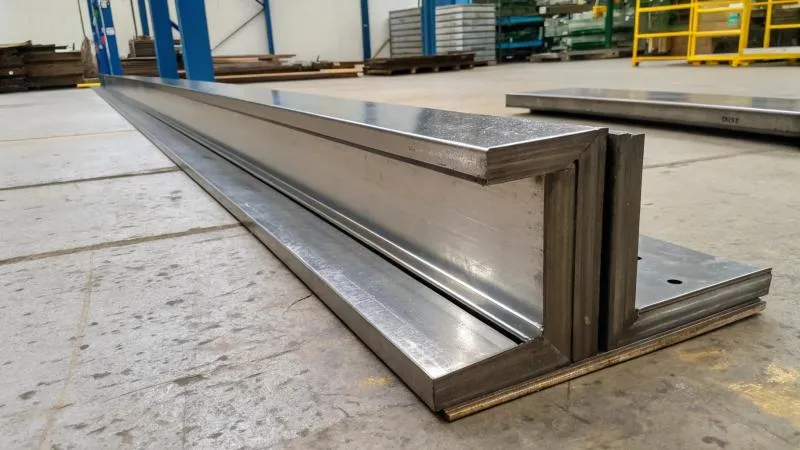

Marine angles are a specialized product. Their price trend does not always match the trend for common rebar or hot-rolled coil.

First, the demand is more stable. Shipbuilding projects have long timelines (2-4 years). Shipyards must buy steel according to their schedule, not just when prices are low. This creates a steady base demand.

Second, the supply is limited. Not every mill produces ABS/DNV-certified L-shaped steel. This reduces the oversupply risk seen in common steel products.

Third, the cost structure is different. Marine steel requires more alloying elements and strict quality control, which adds a relatively fixed cost premium.

So, while general steel prices might dip, marine L-angle prices may hold firmer. For a buyer, this means you cannot rely only on general market news. You need to track the specific indicators for the shipbuilding industry.

How to predict steel prices?

Predicting exact prices is impossible. But you can build a forecast framework. This framework helps you understand risks and make better timing decisions.

You predict steel prices by monitoring key indicators: raw material prices (iron ore futures), Chinese mill production data, inventory levels at major ports, global demand signals (like new ship orders), government policies, and currency exchange rates (USD/CNY). Combining these factors gives you a directional view.

Prediction is about reducing uncertainty. You need to watch the right data points. Think of them as signals on your dashboard.

Your Steel Price Forecasting Dashboard: Key Metrics to Watch

To build your own view, track these five categories of information. I check them weekly.

| Indicator Category | Specific Metrics to Watch | Where to Find the Data | What It Tells You |

|---|---|---|---|

| 1. Raw Material Costs | Iron Ore 62% Fe CFR China futures, Coking Coal prices, Scrap steel prices. | Trading platforms like Fastmarkets, Mysteel, S&P Global. | This is the fundamental cost floor for making steel. Rising ore prices often lead to higher steel prices after 1-2 months. |

| 2. Chinese Supply Data | Weekly crude steel production, daily output from key mills, inventory levels at major ports (e.g., Shanghai, Tianjin). | Chinese industry websites (Mysteel, Custeel), news reports. | High production with rising inventory suggests oversupply and potential price drops. Falling inventory with stable production suggests tightening supply. |

| 3. Demand Indicators | New shipbuilding orders (in Compensated Gross Tonnage), PMI (Purchasing Managers’ Index) for key importing countries (e.g., Vietnam, Saudi Arabia). | Clarksons Research, national statistical bureaus. | Strong new orders mean future demand for marine steel is locked in, supporting prices. |

| 4. Policy & Macro Factors | Chinese government announcements on economic stimulus or environmental production cuts. US Federal Reserve interest rate decisions. | Financial news (Bloomberg, Reuters), official government channels. | Stimulus can boost demand. Interest rate hikes can slow global economic activity and reduce demand. |

| 5. Freight & Logistics | Container shipping rates from China to key ports (e.g., Jebel Ali, Dammam, Houston). | Freightos, Xeneta, quotes from your forwarder. | High freight costs increase the total delivered price for importers, which can dampen demand and affect the FOB price exporters can charge. |

You do not need to be an expert on all of these. Pick two or three that are most relevant to your business. For marine steel, I focus most on iron ore prices and new shipbuilding orders.

A Practical Example from Our Business

Last quarter, we saw iron ore prices climb by 15% over eight weeks. At the same time, Clarksons reported a strong quarter for new tanker orders. Our internal system flagged this. We advised our long-term clients, like Gulf Metal Solutions, that prices were likely to increase in the next 60-90 days. Some chose to place forward orders to lock in the current price. Others decided to wait, betting that high Chinese inventories would limit the increase. Both decisions were informed. The key was having the data to start the conversation. Prediction is not about being right every time. It is about being less wrong and having a plan for different scenarios.

What is the world steel forecast for 2025?

You are planning budgets and projects for next year. You need a realistic range for steel costs. A clear forecast helps you negotiate with clients and manage cash flow.

The world steel forecast for 2025 suggests moderate growth with continued volatility. Organizations like the World Steel Association (worldsteel) project global steel demand to grow by 1-2% in 2025. Prices are expected to average slightly higher than 2024 levels, supported by raw material costs and green transition investments, but capped by sufficient Chinese supply capacity.

Major agencies release annual forecasts. These reports are useful starting points. But you must read them with a critical eye for your specific segment.

Interpreting Broad Forecasts for the Marine Steel Niche

The World Steel Association (worldsteel) forecast is a good benchmark. For 2025, they expect:

- Global Demand: Growth of around 1.7%, led by India, Southeast Asia, and the Middle East.

- Chinese Demand: To remain flat or decline slightly as the property sector adjusts.

- Key Drivers: Investment in infrastructure, energy transition (wind turbines, pipelines), and manufacturing.

But this is for all steel. We need to filter this for marine L-shaped steel.

| Global Forecast Theme | Impact on Marine L-Angle Steel | Our Interpretation |

|---|---|---|

| Growth in India & ASEAN | Positive. These regions have growing shipbuilding and repair industries. This increases direct demand for marine sections. | We expect export orders from India and Vietnam for angles to remain strong. |

| Flat Demand in China | Neutral/Positive. Low domestic demand means Chinese mills will focus on exporting to clear inventory, keeping export prices competitive. | As a Chinese exporter, this helps us offer good prices. But it also increases competition among exporters. |

| Investment in Energy | Very Positive. Offshore wind farm construction uses massive amounts of steel, including large profiles for foundations. This competes for mill capacity. | This may tighten supply for certain sizes and grades, potentially pushing prices for heavy angles higher. |

| Geopolitical Uncertainty | Negative. Trade route disruptions or new tariffs can create sudden logistics bottlenecks and cost spikes. | We advise clients to diversify shipping routes and consider slightly higher inventory buffers. |

The "Green Steel" Factor: A Wildcard for 2025

A new factor is emerging. Some European and Korean shipyards are starting to ask for "green steel" – steel made with lower carbon emissions. This process is more expensive. In 2025, this will not affect the majority of the market. But for premium projects, it could create a two-tier price system. Standard marine angles will follow the general forecast. "Green" certified angles may command a significant premium. As a supplier, we are already talking to our mills about their decarbonization roadmaps to prepare for this future demand.

What is the global steel market trend?

The steel market is not just about price. Larger forces are changing how steel is made, traded, and used. You need to see these trends to position your business for the future.

The global steel market shows three key trends: shifting production to Asia (especially India), growing demand for higher-grade and "green" steel, and increased protectionism with trade barriers. For buyers, this means supply chains are reorganizing, product specifications are rising, and logistics complexity is increasing.

These trends move slowly, but they change the landscape. Ignoring them is a risk. Let’s examine each one and its practical impact.

Three Mega-Trends Reshaping the Steel Industry

The table below summarizes the core trends, their causes, and what they mean for an importer of marine steel.

| Global Trend | What Is Happening | Direct Impact on Marine Steel Importers |

|---|---|---|

| 1. Geographic Shift in Production | China’s production share is peaking. India is rapidly expanding capacity and aims to be the world’s second-largest producer. Southeast Asia is also building new mills. | More Supply Options: In the future, you may source from India or Vietnam, not just China. Increased Competition: More suppliers may lead to better prices but require new quality audits. |

| 2. Demand for Premium & Green Steel | Shipowners and offshore operators demand longer-lasting, higher-strength steel to reduce maintenance. Environmental regulations push for low-carbon footprint steel. | Higher Specifications: Orders for EH40 or FH40 grades may increase. New Costs: "Green" steel premiums and more stringent certification requirements add cost and complexity. |

| 3. Rise of Protectionism & Trade Barriers | Countries impose tariffs (like Section 232 in the US), quotas, and carbon border taxes (like EU CBAM) to protect local industry or meet climate goals. | Supply Chain Fragmentation: You may need different suppliers for different regions. Increased Paperwork: Compliance with rules of origin and carbon reporting becomes mandatory. |

For a business like ours, based in China, these trends present both challenges and opportunities.

Our Strategy: Adapting to the Global Trends

We are not just watching these trends; we are acting on them.

For Production Shift, we are strengthening our partnerships with top-tier mills in China. Their focus is shifting from volume to value. They are improving quality and efficiency to compete with future Indian exports. This benefits our clients through more stable quality.

For Premium & Green Steel, we are proactively obtaining environmental product declarations (EPDs) from our partner mills. We are also stocking a wider range of high-toughness grades (EH36, FH36) to meet the demand for more durable ships.

For Protectionism, we are developing a stronger logistics network. We help clients with customs clearance support in key markets like Saudi Arabia and Vietnam. We understand that smooth logistics is as important as the product price in a fragmented trade world.

The client feedback from Gulf Metal Solutions mentioned our excellent packaging and reliable delivery to Dammam port. This is not an accident. It is a direct result of our focus on the "logistics complexity" trend. In today’s market, a reliable supplier is one who manages both the product and the global trade environment for you.

Conclusion

Navigating marine L-shaped steel prices requires understanding cyclical drivers, monitoring key indicators, and adapting to long-term global shifts. By focusing on specific demand signals and partnering with a responsive supplier, you can make informed decisions in a volatile market.