You need marine steel plate for a shipbuilding project. You look at the global market and see one dominant supplier. Why does China consistently come out on top for both availability and price?

China leads in marine steel plate production due to its massive scale, fully integrated supply chain, and strategic focus on heavy industry. The country’s enormous steel output, combined with its position as the world’s top shipbuilder, creates a powerful ecosystem where demand drives specialized, high-quality production at competitive costs.

This leadership is not just about making more steel. It is about making the right kind of steel for a specific, demanding industry. As a supplier based in Shandong, the heart of China’s steel industry, I see this synergy every day. Our mill partners produce AH36, DH36 plates and bulb flats specifically for the shipyards in Jiangsu and Zhejiang. This close loop explains China’s dominance. Let’s examine the key factors, starting with the foundation of it all: raw steel production.

Why is China the largest producer of steel?

China produces more than half of the world’s steel. This fact shapes global markets. The reasons are a mix of government policy, economic need, and massive infrastructure development over the past three decades.

China is the largest producer of steel because of massive domestic demand from construction and manufacturing, strong government industrial policy, and large-scale investments in modern, efficient steelmaking capacity. The country’s rapid urbanization and infrastructure boom created an insatiable need for steel that its industry grew to meet.

The Pillars of Chinese Steel Supremacy

China’s steel output is not an accident. It is the result of deliberate, long-term strategies and unique economic conditions. We can break down the dominance into three main pillars.

First, unprecedented domestic demand was the primary engine. From the 1990s onward, China underwent the largest and fastest urbanization in human history. Hundreds of millions of people moved to cities. This required building everything: skyscrapers, highways, railways, airports, and housing. All this construction consumed enormous amounts of steel. At the same time, China became the "world’s factory." Manufacturing industries for appliances, machinery, cars, and ships all need steel. This internal demand gave steel mills a huge, stable market. They could invest in larger facilities knowing the steel would be used.

Second, government policy played a decisive role. The Chinese government identified steel as a strategic industry. It supported the sector through the "Five-Year Plans." Policies included:

- Encouraging the consolidation of smaller mills into large, state-backed groups like Baowu Steel (now the world’s largest).

- Providing access to low-cost capital for building new, modern plants.

- Securing long-term supplies of key raw materials, like iron ore and coking coal, through investments in mines abroad.

The goal was to achieve self-sufficiency and then export capability in a vital industrial material.

Third, China invested in scale and technology. Chinese steel companies built massive, integrated steel complexes. An integrated plant controls the entire process from iron ore to finished coil or plate. These plants are very efficient at high volumes. In the last 15 years, the focus shifted from just quantity to quality. The government forced the closure of old, polluting blast furnaces (the "zombie" mills). It encouraged the construction of new, advanced facilities. Today, many top Chinese mills have world-class equipment for producing high-grade steel like marine plates.

To understand the scale, look at this data comparison:

| Factor | China’s Position / Approach | Impact on Steel Production Leadership |

|---|---|---|

| Annual Production Volume | Over 1 billion metric tons (about 55% of global output). | Volume creates economies of scale that lower the cost per ton. |

| Plant Type | Dominance of large, integrated coastal steelworks (e.g., in Shandong, Hebei). | Integrated plants are most efficient for large-scale, consistent production of flat products like plate. |

| Raw Material Security | Major investor in overseas iron ore mines (Australia, Brazil, Africa). | Reduces vulnerability to price swings and ensures stable supply for blast furnaces. |

| Domestic Market Demand | The world’s largest construction and manufacturing sector. | Provides a guaranteed base load for mills, allowing them to run at high capacity. |

| Government Policy | Active industrial planning, consolidation targets, technology upgrades. | Directs investment, removes inefficient capacity, and focuses the industry on strategic goals. |

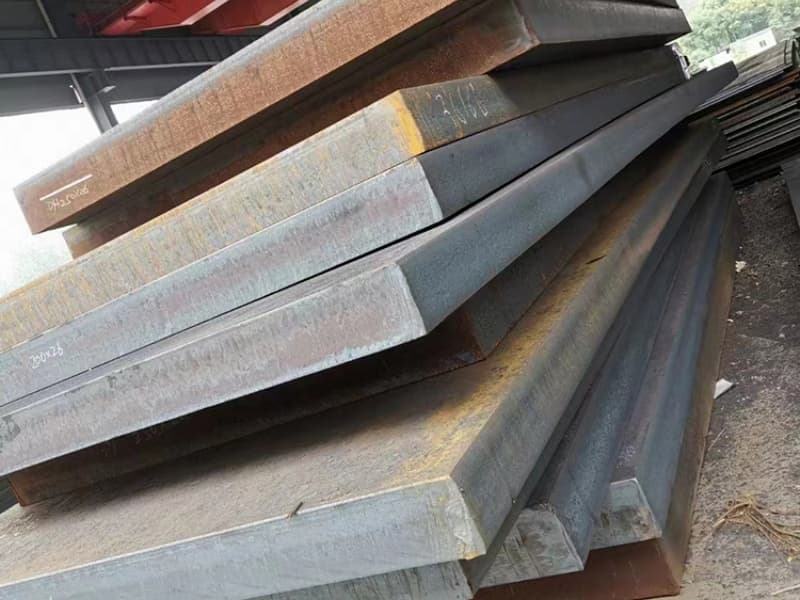

From our perspective in the industry, this scale translates directly to benefits for buyers. Because the mills produce such vast quantities, they can dedicate specific production lines to specialized products. A mill we work with in Liaocheng has a rolling line configured just for ship plate. They can produce AH36 to LR/ABS/DNV standards in large batches. This specialization, born from scale, leads to consistent quality and readily available stock. This is the foundational reason why China is the default source for global marine steel procurement.

Why is China cutting steel production?

This seems like a contradiction. If China leads in production, why would it cut output? The answer lies in a strategic shift from quantity to quality and a response to new national priorities.

China is cutting steel production to reduce pollution, improve energy efficiency, and curb overcapacity in lower-value steel. The government aims to peak carbon emissions before 2030. Reducing output from older, polluting mills is a key part of this environmental and industrial upgrade policy.

The Logic Behind the Output Reduction

The production cuts are not a sign of weakness. They are a deliberate recalibration. China is moving its steel industry up the value chain. This has important implications for marine steel buyers.

First, the primary driver is environmental. For many years, the steel industry was a major source of air pollution. The government is now committed to "blue skies." Old blast furnaces and basic oxygen furnaces that lack modern emission controls are being shut down permanently. This is part of the "capacity swap" policy. Mills are allowed to build new, cleaner capacity only if they close a larger amount of old, dirty capacity. The goal is to reduce total emissions even if output remains high.

Second, the goal is to eliminate overcapacity in low-end steel. In the past, there were too many mills producing common rebar or low-grade plate. This led to price wars and low profitability. The government is forcing consolidation. Smaller, inefficient mills are closed. Production is concentrated in the hands of a few large, advanced groups like Baowu, Ansteel, and Shougang. These groups are profitable and can invest in R&D.

Third, this policy actually benefits the marine steel sector. Here is why:

- Focus on High-Value Products: The mills that survive and expand are the ones producing high-value-added steel. Marine grade plate (AH36, DH36, EH36) is exactly this type of product. It requires precise chemistry control, advanced rolling technology, and certification. The policy encourages mills to focus on these grades rather than generic commodity steel.

- Stable Supply from Major Mills: Buyers like us now source from large, state-backed mills with clear long-term futures. Their production is stable and predictable. We don’t worry about a key supplier suddenly being shut down for environmental reasons.

- Improved Quality Consistency: Advanced mills have better process control. This means the chemical composition and mechanical properties of each batch of AH36 plate are more consistent. This is critical for shipyards that need reliable material.

The production cut policy is nuanced. Look at this breakdown:

| Type of Production Target | What is Being Cut | What is Being Maintained or Expanded |

|---|---|---|

| Overall Crude Steel Output | Annual output is capped to meet carbon goals. Growth is flat or slightly down. | The share of high-quality, high-value steel within the total output is increasing. |

| Production Capacity | Inefficient, polluting capacity is forcibly eliminated (e.g., induction furnaces, small blast furnaces). | Modern, large-scale, environmentally friendly capacity is encouraged through "capacity swap" approvals. |

| Product Mix | Low-value, generic construction steel (like certain rebar) faces more restrictions. | Production of high-strength, wear-resistant, corrosion-resistant, and specialized steel (like marine plate) is supported. |

| Geographic Location | Mills in heavily polluted areas (e.g., around Beijing) are relocated or closed. | New capacity is built in coastal industrial zones with better logistics for export (like Shandong, where we are based). |

For international buyers, this is crucial to understand. Some buyers hear "China is cutting steel production" and fear scarcity or rising prices for all steel. The reality is different. For marine grade plate, the supply from approved, top-tier mills is secure and may even be growing in terms of market share. The competition is now based on quality, certification, and service rather than just the lowest price for any steel. Our clients, such as the project contractor in Saudi Arabia, appreciate this. They need a supplier who can guarantee not just a one-time shipment, but a consistent supply of certified AH36 plate for multiple projects over years. The ongoing industrial upgrade in China makes reliable suppliers like us more valuable.

How did China become the world’s biggest shipbuilder?

Shipbuilding and steel production are twin industries. China’s rise in shipbuilding is both a cause and a consequence of its leadership in marine steel. The two industries fuel each other in a powerful cycle.

China became the world’s biggest shipbuilder through massive investment in modern shipyards, lower labor costs, strong government support, and most importantly, a fully domestic and competitive supply chain for all key materials, especially marine steel plate.

The Shipbuilding-Streel Symbiosis

China’s shipbuilding dominance did not happen overnight. It followed a clear path where control over the steel supply provided a decisive strategic advantage.

First, the initial advantage was cost. In the 2000s, Chinese shipyards offered significantly lower building prices than competitors in Japan and South Korea. This was due to lower labor costs and government subsidies for the industry. Ship owners from Europe and Greece placed orders in China. This created initial volume and experience.

Second, and more importantly, China developed a complete industrial ecosystem. A ship is about 80% steel by weight. The most critical material is marine-grade steel plate. Chinese shipyards did not need to import this steel from Japan or Korea. They could source it domestically from mills just a few hundred kilometers away. This provided huge advantages:

- Lower Material Cost: No import tariffs, lower transportation costs.

- Faster Delivery: Steel plates could be delivered by truck in days, not weeks by sea.

- Better Coordination: Shipyard engineers could work directly with mill technicians to specify exact grades, sizes, and delivery schedules.

- Just-in-Time Inventory: Yards could reduce costly steel inventory because they could reorder quickly.

Third, the government supported strategic clustering. Major shipbuilding bases were established in coastal provinces: Jiangsu, Zhejiang, Shanghai, Liaoning, and Shandong (our base). These regions also had large steel mills. The government encouraged this clustering through infrastructure (ports, highways) and policy. This created a "shipbuilding valley" similar to Silicon Valley for tech.

Fourth, technology transfer and scale amplified the advantage. Chinese companies acquired technology through joint ventures with foreign designers. They then built the world’s largest and most efficient shipyard facilities, like the Jiangnan Changxing Shipyard. These mega-yards can build multiple giant container ships or LNG carriers simultaneously. Their scale demands a colossal, steady flow of marine steel plate. Only China’s own steel industry could reliably supply this.

The relationship between the two industries is shown in this cycle:

| Step in the Cycle | What Happens | Result for China’s Position |

|---|---|---|

| 1. Domestic Steel Supply | Mills produce high-quality AH36/DH36 plate at competitive cost. | Shipyards get a reliable, affordable key material. |

| 2. Competitive Shipbuilding | Yards offer lower build prices and shorter wait times due to material advantage. | Global ship owners place more orders in China. |

| 3. Increased Shipyard Demand | Yards expand to handle more orders, demanding even more steel. | Mills invest in more advanced marine steel production lines. |

| 4. Improved Steel Quality & Variety | Mills develop new grades (e.g., for LNG carriers) to meet yard specs. | Yards can build more advanced, profitable ship types. |

| Cycle Repeats | The enhanced steel supply makes Chinese yards even more competitive. | China consolidates its lead in both industries. |

We see this cycle in action. The mills we work with have long-term contracts with major shipyards like CSSC and Yangzijiang Shipbuilding. Their production schedules are aligned. When a shipyard starts a new series of bulk carriers, the mill knows to prepare X tons of AH36 plate in specific thicknesses. This deep integration is something no other shipbuilding nation can match to the same degree. As a steel supplier, we are part of this ecosystem. We help international buyers who are not building entire ships in China but need the same quality steel for repairs, conversions, or local fabrication projects. We give them access to the same supply chain that powers the world’s largest shipbuilder.

Which country is no. 1 in steel production?

The answer is clear and has been for nearly two decades. China’s position is so dominant that it produces more than the next ten countries combined. This fact is the bedrock of its leadership in marine steel.

China is the undisputed number one country in steel production, responsible for over half of the world’s total output. India is a distant second, followed by Japan and the United States. China’s volume is so large that its production decisions directly influence global steel prices and availability.

Understanding the Scale of China’s #1 Position

Being number one is not just about ranking. It is about the sheer magnitude of output and its implications for specialized sectors like marine steel. Let’s put the numbers in context.

First, look at the numbers from the World Steel Association. In a typical recent year:

- China: ~1.0 billion metric tons

- India: ~125 million metric tons

- Japan: ~90 million metric tons

- United States: ~85 million metric tons

China’s output is roughly 8 times that of India, the number two producer. It produces more steel in one month than many countries produce in a full year. This scale is unprecedented in industrial history.

Second, this scale creates a "home market effect" for marine steel. Because the total steel pie is so enormous, even a small percentage dedicated to a specialized product results in a huge absolute volume. Let’s assume only 5% of China’s output is ship plate and sections. That is still 50 million metric tons of marine steel annually. This volume is larger than the total steel output of Germany or Turkey. This means Chinese mills can achieve incredible specialization and efficiency in marine steel production lines. They can run these lines continuously, which improves quality consistency and lowers unit cost.

Third, compare the top producers in terms of marine steel capability.

- China: Has dozens of mills approved by all major classification societies (LR, ABS, DNV, etc.) to produce AH/DH/EH grades. The product range is complete, from thin plate to very thick plate, and all standard sections (bulb flats, angles).

- Japan & South Korea: They are also excellent producers of high-quality marine steel (e.g., JFE, POSCO). However, their total production volume is much lower. They often focus on the most premium segments, like steel for LNG carriers or naval vessels. Their prices are generally higher.

- India & Russia: They are growing steel producers, but their marine steel industry is not as mature or widely certified. Export availability and consistency can be challenges.

- EU & USA: Their steel industries are much smaller and often focus on domestic markets or very specific high-end products. They are not major exporters of standard marine plate like AH36.

This comparison is best seen in a table:

| Country | Approx. Annual Steel Production | Marine Steel Production Strength | Key Characteristics for Buyers |

|---|---|---|---|

| China (No. 1) | ~1,000 Million Tons | Extremely Strong. Highest volume, full grade range, widespread certification, competitive pricing. | Best for availability, cost, and variety. The default global supplier. |

| India (No. 2) | ~125 Million Tons | Growing. Some mills are class-approved. Quality can be variable. | Potential alternative, but supply consistency and export logistics may be less mature. |

| Japan (No. 3) | ~90 Million Tons | Technically Strong. Excellent quality, especially for advanced grades. | Premium option for high-spec projects, but at a higher cost and possibly longer lead time. |

| South Korea (No. 6) | ~70 Million Tons | Technically Strong. Closely tied to its giant shipbuilding industry. | High quality, but often consumed domestically by Hyundai, Samsung, etc. Less available for export. |

| European Union | ~150 Million Tons (combined) | Niche Strong. Certain mills produce high-quality plate. | Good for regional supply within Europe, but volumes are limited and prices are high for global export. |

For a B2B buyer, China’s #1 position means practical benefits.

- One-Stop Sourcing: You can find all marine steel products (plate, angle, bulb flat) from the same country, often from related mills.

- Competitive Pricing: The intense competition among many large Chinese mills keeps prices sharp.

- Logistics Network: Major Chinese ports like Tianjin, Qingdao, and Shanghai are optimized for exporting heavy steel cargo. Shipping schedules to the Middle East, Southeast Asia, and beyond are frequent and cost-effective.

- Quality Choice: You can choose from basic AH36 to the highest EH40 grades, all with proper certification.

Our business model is built on this reality. We are located in Shandong, close to the mills and the port of Qingdao. We can offer "fast delivery from Liaocheng, Shandong" because we are in the center of the world’s largest and most efficient steel production and export system. When our client in the Philippines needs 200 tons of AH36 plate for a ship repair, we can confirm stock, arrange SGS inspection, and book vessel space quickly. This operational efficiency is a direct result of China’s scale and integrated supply chain.

Conclusion

China leads in marine steel plate production because of its unparalleled scale, a deeply integrated supply chain with its shipbuilding industry, and a strategic shift towards producing high-value, certified grades for the global market.