You request quotes from five suppliers for a 500-ton order. The prices vary by 30%. You can’t tell if the low price is a great deal or a trap. Getting the "best" price isn’t about finding the lowest number; it’s about understanding what drives cost and how to negotiate from a position of knowledge.

The best price for bulk marine steel comes from strategic sourcing: order consolidation (plates, sections together), precise specifications, flexible timing to leverage market dips, building long-term supplier relationships, and understanding total landed cost (including shipping, duties), not just the FOB price per ton.

Chasing the absolute lowest quoted price often leads to quality issues, hidden costs, and unreliable delivery. A strategic buyer focuses on value and total cost of ownership. Let’s decode the factors that influence price and build a practical framework for securing the best deal on your next bulk order.

How much does 1 ton of steel cost?

You search online for "steel price per ton" and get a wide range. The number is meaningless without context. Asking for the price of "steel" is like asking for the price of "a car"—it depends completely on the model, features, and location.

There is no single price for 1 ton of steel. The cost varies by type (e.g., carbon steel vs. stainless), grade (e.g., A36 vs. AH36), form (plate, coil, section), market (China, EU, USA), and quantity. As a baseline, commodity hot-rolled coil (HRC) might be $500-$800 per ton FOB China, while certified marine-grade plate (ABS AH36) can be $150-$300+ more per ton, plus additional costs for processing, testing, and shipping.

The quoted price is just the starting point. It’s a composite of many underlying costs. To negotiate effectively, you must understand what you’re actually paying for. Let’s break down the anatomy of a marine steel price quote.

Deconstructing a Price Quote: The Layers of Cost

When you receive a quote for marine steel, you are seeing the sum of several cost components. A transparent supplier will break these down; others give a single number. Knowing the components gives you negotiation leverage.

1. Base Material Cost (The Mill Price)1:

This is the largest component. It is driven by:

- Raw Material Costs: Iron ore and coking coal prices. These are global commodities and are very volatile.

- Production Cost: Energy, labor, and mill efficiency.

- Grade Premium: Marine grade (AH36) costs more than standard structural steel (S355) due to stricter chemistry control and testing. Higher strength (AH40) or better toughness (EH36) commands further premiums.

- Form Premium: Producing specific sections like bulb flats or unequal angles is more complex than rolling standard plate, so they often cost more per ton.

2. Processing and Value-Added Costs2:

- Cutting to Size: Mill shearing or plasma cutting to your exact dimensions.

- Surface Treatment: Blast cleaning, priming, or pickling.

- Testing and Certification: The cost of generating the Mill Test Certificate (MTC) 3.1, and any extra tests (UT, Charpy at multiple temperatures).

3. Supplier Margin and Logistics3:

- Supplier’s Profit Margin: This covers their operations, sales, and technical support.

- Inland Freight: Transport from the mill to the Chinese export port (e.g., Liaocheng to Qingdao).

- Port Charges: Handling, documentation, export customs fees.

4. Shipping and Delivery Terms (Incoterms)4:

The quoted price changes dramatically based on terms:

- EXW (Ex-Works): Price at the factory gate. You pay for all freight, insurance, and risk.

- FOB (Free On Board): Price includes delivery to the Chinese port and loaded on the vessel. You pay ocean freight and insurance.

- CIF (Cost, Insurance, Freight): Price includes delivery to your destination port. You pay import duties and local delivery.

- DAP (Delivered At Place): Price includes delivery to your project site (excluding import duties).

Example Price Breakdown (Simplified):

For 100 tons of ABS AH36 Plate, 10mm thick, FOB Qingdao:

| Cost Component | Estimated USD/Ton | Notes |

|---|---|---|

| Base Mill Price for AH36 Plate | $720 | Linked to HRC index + grade premium. |

| Cutting to Size | $15 | For specific rectangle cuts. |

| MTC & Standard Testing | $10 | Included in mill price, but some suppliers list it. |

| Inland Freight (Mill to Port) | $25 | Depends on distance. |

| Port Charges & Loading | $15 | Documentation, handling. |

| Supplier Margin & Overhead | $50 | Covers sales, quality control, profit. |

| Total FOB Price per Ton5 | $835 | The number you see on the quote. |

The Key Takeaway: When comparing quotes, ensure they are for the ex same product, same specifications, and same Incoterms. A quote for "AH36 plate" that is $50/ton cheaper might be for a non-certified source, a different thickness tolerance, or EXW terms. Always compare total landed cost6—the final cost at your yard. This includes the FOB price, ocean freight, insurance, import duties, and local trucking. A higher FOB price from a supplier with better logistics might result in a lower landed cost.

Are steel prices falling?

You see a news headline: "Steel Prices Drop1." Should you delay your order to get a better deal? Or is this a temporary dip before a sharp rise? Timing the market is risky, but understanding price cycles2 helps you make smarter purchasing decisions.

Steel prices are cyclical and volatile. They can fall due to decreased demand (economic slowdown), lower raw material costs (iron ore, scrap), increased supply (new mill capacity), or government policy changes. However, predicting the exact timing and duration of a price fall is difficult. For project planning, a stable supply at a known price is often more valuable than attempting to time the market bottom.

A simple "yes" or "no" answer is not helpful. The real question is: "What are the current market drivers, and what is their likely impact on my procurement timeline?" Let’s analyze the factors that cause prices to move.

Understanding Price Volatility: The Market Forces at Play

Steel is a global commodity. Its price is influenced by macro-economic factors, not just supply and demand for your specific grade. Think of it as a large ship—it takes time to change direction.

Factors That Cause Prices to FALL:

- Weak Demand3: A slowdown in construction, manufacturing, or shipbuilding reduces orders to mills. This is the most powerful driver.

- Overproduction4: When mills continue producing at high rates despite weak demand, inventories build, and prices drop to clear stock.

- Falling Raw Material Costs5: A significant drop in the price of iron ore or scrap metal reduces the mill’s input costs, which can be passed on.

- Export Policy Changes6: If a major exporter (like China) removes export tariffs or provides rebates, global supply increases, pushing prices down.

- Strong Currency: If the Chinese Yuan strengthens against the USD, Chinese steel becomes more expensive for foreign buyers, reducing demand and potentially forcing domestic price cuts.

Factors That Cause Prices to RISE:

- Strong Demand7: Booming infrastructure projects or a recovery in manufacturing.

- Production Cuts: Mills reducing output (due to losses, environmental policies, or maintenance) tighten supply.

- Rising Raw Material & Energy Costs: Increased costs for coal, electricity, and iron ore are passed through.

- Trade Restrictions: Tariffs, quotas, or anti-dumping duties reduce supply in a region, raising local prices.

- Logistics Bottlenecks8: High shipping freight rates add to the delivered cost.

What This Means for Your Bulk Order Strategy:

You cannot control the market, but you can adapt your procurement tactics.

| Market Condition | Indicator | Recommended Procurement Tactic |

|---|---|---|

| Prices Falling | HRC futures trending down, high mill inventories reported. | Consider flexible timing. Place smaller orders or use price escalation clauses in contracts for long-term projects. Be ready to act if the trend is clear. |

| Prices Rising | Strong demand reports, rising iron ore prices, mill order books full. | Lock in prices early. Place firm orders for future requirements. Consider hedging if you are a very large buyer. |

| Prices Volatile/Uncertain | Mixed signals, geopolitical instability. | Focus on stable relationships. Negotiate with a trusted supplier for a fair price tied to a known index over time, rather than gambling on spot prices. Build in contingency budgets. |

The Role of a Trusted Supplier:

A good supplier provides market intelligence, not just a quote. They can tell you if a price drop is due to a genuine market shift or if it’s from a low-quality source. They can also advise on timing based on mill production schedules. Our long-term cooperation with mills gives us visibility into their order books and cost pressures, allowing us to give clients more informed guidance on when to buy.

What is the best index to track steel prices?

You want to understand market trends to negotiate better. But which of the many price indices should you follow? Using the wrong index is like checking the weather in a different country to plan your local day.

The best index to track for international marine steel procurement is the Chinese domestic Hot-Rolled Coil (HRC) price, often referenced as the Shanghai HRC spot price. HRC is the base product from which many plates and sections are made. Other relevant indices include CRU (global), TSI (The Steel Index), and Platts assessments for specific regions and products.

Indices are tools. They provide a benchmark, not the exact price you will pay. Your negotiated price will be the index value plus or minus various premiums and adjustments. Knowing how to use the index is key.

Navigating the Indices: From Benchmark to Contract Price

Price indices serve two main purposes: they provide market transparency and are used as a basis for contract pricing in some deals.

Primary Indices for Marine Steel Buyers:

- Shanghai HRC Spot Price (中国上海热轧卷板价格): This is the most direct indicator for steel sourced from China. It reflects daily traded prices for commodity-grade hot-rolled coil in China’s largest market. Since most marine plates start as HRC before further processing, this index is a fundamental driver.

- CRU (Commodity Research Unit) Steel Price Indices: A globally recognized provider. They publish indices for HRC, rebar, and other products in different regions (China, N. America, Europe). Used by many mills and large buyers for reference.

- TSI (The Steel Index): Part of S&P Global Commodity Insights. Provides daily price assessments for steel, scrap, and iron ore. Widely used in physical and derivative contracts.

- Platts: Another major price reporting agency (PRA). Their daily steel assessments are also industry benchmarks.

How to Use an Index for Procurement:

You don’t buy at the index price. You buy at a price derived from the index. A typical negotiation might settle on a formula:

Final Price = [HRC Index Value on a specified date] + [Fixed Premium]

- The Premium covers everything beyond the base coil cost: the marine grade chemistry, the rolling into plate or section, testing, certification, and the supplier’s margin.

- Example: A contract might state: "Price per ton = CRU China HRC Index (average of Month X) + $180 premium." This separates the volatile base material cost (tracked by the index) from the relatively stable processing premium.

Advantages of Index-Linked Pricing:

- Transparency: Both buyer and supplier can see the basis for the price.

- Fairness: The buyer shares in market downturns, and the supplier is protected in upturns (within the premium).

- Reduces Speculation: Removes the need to constantly re-quote and re-negotiate.

Limitations and Cautions:

- Lag Time: Indices report past trades. They may not predict tomorrow’s price perfectly.

- Product Specificity: The HRC index is for commodity coil. Your specific marine plate or bulb flat has its own supply-demand dynamics. The premium can change.

- Source: Ensure you and your supplier agree on which exact index (e.g., CRU China HRC EXW North China) will be used.

For our bulk order clients, we often provide quotes that reference the current market index and explain the premium. This builds trust. It shows our price isn’t arbitrary but is based on a transparent market mechanism plus the clear value we add in sourcing certified marine-grade products.

What’s the price of steel at the moment?

You need a quote for budgeting today. A quick Google search gives you a number from six weeks ago. Relying on stale data can wreck your project budget. The "moment" in steel pricing is measured in days, not months.

The price of steel "at the moment" is a spot price that changes daily based on trading activity. You cannot get an accurate, firm price without requesting a specific quote from a supplier for your exact product, quantity, and delivery terms. For reference, you can check live trading platforms or price reporting agencies, but the final contract price will be negotiated.

Asking for "the price" is like asking for "the temperature." You need to specify the location and time. In steel, location is the product grade and destination; time is the validity period of the quote. Let’s define how to get a real, actionable price.

From "Right Now" to a Firm Purchase Order

The journey from a market price headline to a signed contract involves several steps where the price is refined and locked in.

Step 1: Finding a Reference Point (The "Moment")

Before you even contact suppliers, get a market snapshot.

- Tools: Use websites like SteelHome (我的钢铁), SMM (上海有色网), or the CRU/TSI/Platts portals (often behind paywalls). They show recent transaction prices for HRC, rebar, etc., in China.

- Example Snapshot: "As of [Today’s Date], Shanghai HRC Spot Price is reported at $580/ton EXW."

- This is NOT your buying price. It’s a baseline.

Step 2: The Supplier Quote (Price with Context)

You send an RFQ (Request for Quotation) with full details:

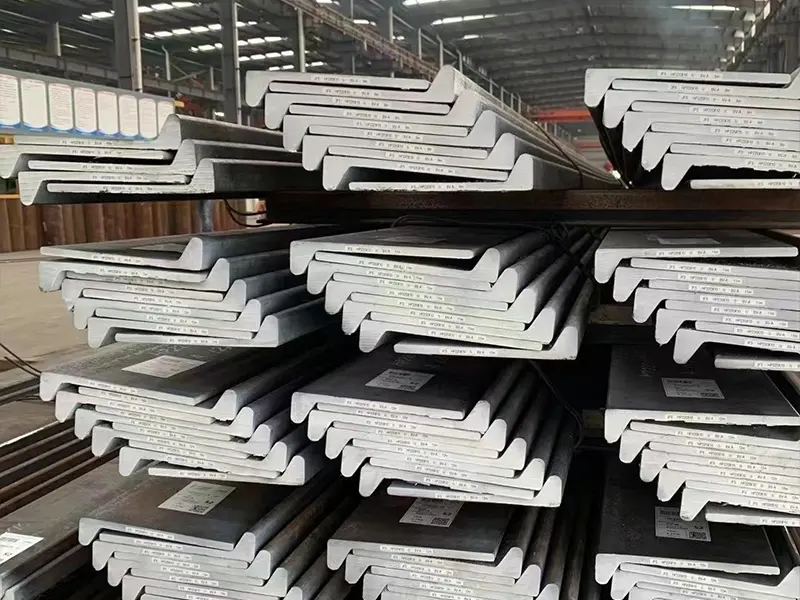

- Product: Marine Angle Steel, L 100x100x10mm

- Grade: ABS AH36

- Quantity: 200 tons

- Destination: CIF Jebel Ali, UAE

- Required Documents: MTC 3.1, SGS Inspection

The supplier’s response will be a firm offer with a validity period (e.g., 7 days). This price incorporates the market snapshot, their mill costs, their margin, and freight estimates.

Step 3: Factors That Change the Price "in the Moment"

Between your snapshot and the supplier’s quote, these factors cause variation:

- Mill Stock Levels: If the mill has high inventory of the exact size you need, the price might be softer.

- Currency Exchange Rates (USD/CNY): The quote is in USD. If the Yuan strengthens after the quote is given, the supplier’s cost in local currency rises. They may be reluctant to extend the quote validity.

- Freight Rate Fluctuations: For CIF quotes, ocean freight costs can change weekly.

Step 4: Locking It In – The Purchase Order

Once you accept the quote within its validity period, you issue a Purchase Order (PO). The price on the PO and the subsequent Sales Contract is now fixed (unless there’s an escalation clause). This is your "price at the moment" of commitment.

Practical Checklist for Getting a Real Price:

| Action | Purpose | Outcome |

|---|---|---|

| 1. Prepare a Detailed RFQ. | Eliminates guesswork for the supplier. | You get comparable, apples-to-apples quotes. |

| 2. Check a market index (e.g., Shanghai HRC). | Gives you a sanity check on the quotes. | You know if a quote is wildly out of line with the market. |

| 3. Request quotes from 2-3 pre-vetted suppliers. | Creates competition based on your exact needs. | You get a range of real, actionable prices. |

| 4. Note the quote validity period. | Knows how long you have to decide. | Prevents surprise price changes after you approve the budget. |

| 5. Compare Total Landed Cost. | Ensures you are comparing the final delivered cost. | Avoids hidden cost surprises with logistics. |

Our business is built on providing fast, clear, and valid quotes. As noted by our client, we respond within hours. We know that for a rational, results-driven buyer, a timely and transparent price is the first step in building confidence and securing the order for that next bulk shipment of L-shaped steel.

Conclusion

Securing the best price for bulk marine steel requires understanding cost components, monitoring relevant price indices, strategically timing orders within market cycles, and negotiating based on total landed cost with reliable suppliers.

-

Understanding the reasons behind price drops can help you make informed purchasing decisions. ↩ ↩

-

Exploring price cycles can provide insights into timing your orders effectively. ↩ ↩

-

Identifying the causes of weak demand can help you anticipate price changes. ↩ ↩

-

Learning about overproduction can help you understand market dynamics and pricing. ↩ ↩

-

This knowledge can guide your procurement strategy and cost management. ↩ ↩

-

Understanding export policies can help you navigate international market fluctuations. ↩ ↩

-

Recognizing demand drivers can help you predict price increases and plan accordingly. ↩

-

Exploring logistics issues can provide insights into potential cost increases in steel procurement. ↩