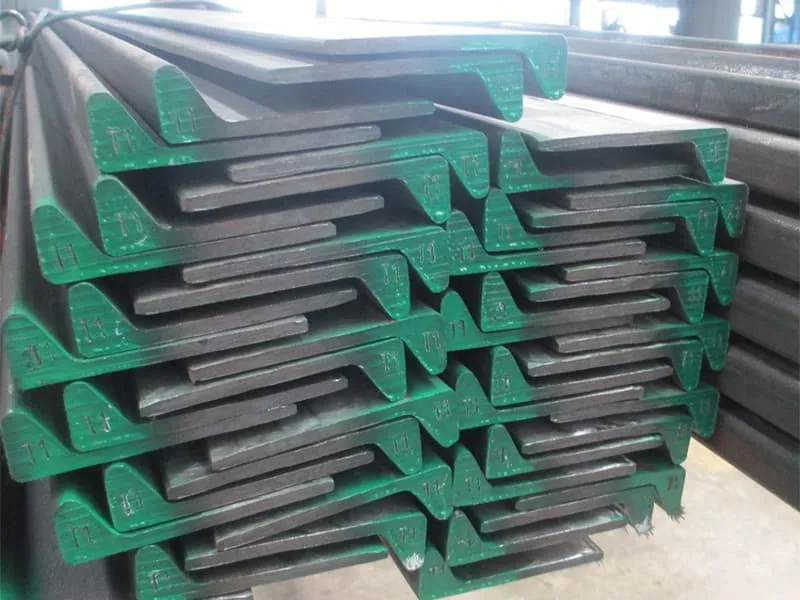

Planning your 2025 marine projects without accurate bulb flat steel pricing can destroy your budget. Many shipyards face shocking cost overruns when they discover current price forecasts. Understanding 2025 pricing trends protects your project viability.

Marine bulb flat steel prices per ton in 2025 will range from $800-$1,200 for standard grades and $1,200-$1,800 for certified marine grades. Prices vary by certification level, quantity, shipping destination, and raw material cost fluctuations. ABS and LR certified bulb flats command 20-30% premiums over standard grades.

Based on my daily negotiations with Chinese mills and international clients, I can provide realistic 2025 price projections. The following analysis will help you budget accurately and avoid unexpected cost increases.

What is the steel price per ton1?

Many buyers get confused by the wide price ranges quoted for seemingly similar steel products. This confusion leads to poor budgeting and supplier selection mistakes that cost projects thousands.

The steel price per ton1 varies from $600 for basic structural steel to $2,000+ for specialized marine grades. Marine bulb flat steel typically costs $800-$1,800 per ton depending on certification, size, quantity, and market conditions. Raw material costs and manufacturing complexity2 create these price differences.

Understanding the Factors Behind Steel Price Variations

Steel pricing involves multiple variables that combine to determine final cost per ton. Understanding these factors helps buyers evaluate quotes and negotiate effectively.

Raw material costs form the price foundation. Iron ore prices typically account for 30-40% of steel production costs. Coking coal adds another 20-25% for blast furnace operations. Scrap steel prices dominate electric arc furnace production costs. These commodity prices fluctuate daily based on global market conditions.

Steel Grade Price Comparison Table:

| Steel Type | Price Range per Ton | Key Cost Drivers | Price Stability | Market Factors |

|---|---|---|---|---|

| Basic Structural | $600-$800 | Raw materials, energy | Low, volatile | Construction demand, imports |

| Standard Marine | $800-$1,200 | Certification, testing | Medium | Shipbuilding activity, regulations |

| ABS/LR Certified | $1,200-$1,800 | Documentation, surveys | High | Classification rule changes |

| Stainless Marine | $2,000-$3,500 | Nickel, chromium content | Low | Nickel prices, specialty demand |

| Arctic Grades | $1,500-$2,200 | Low-temp testing, alloys | Medium | Ice-class vessel orders |

Manufacturing complexity significantly impacts bulb flat pricing. Bulb flats require specialized rolling mills and precise process controls. The unique profile demands experienced operators and careful setup. Reject rates for bulb flats run higher than for simpler sections, adding to production costs.

Certification and testing requirements create substantial cost differences. ABS and LR certification involves surveyor fees, additional testing, and comprehensive documentation. These processes add $150-$300 per ton but ensure material suitability for marine applications. Uncertified steel lacks this assurance.

Market dynamics and regional factors influence final pricing. Chinese domestic demand affects export availability and pricing. Currency exchange rates impact competitiveness. Trade policies and tariffs can suddenly change cost structures for international buyers.

How to calculate steel price per ton?

Many project managers struggle with steel price calculation1s, leading to budget inaccuracies and supplier misunderstandings. Proper calculation methodology ensures realistic project costing.

Calculate steel price per ton by adding base price, size premium, certification costs2, testing fees, and profit margin, then subtracting any quantity discounts3. The formula considers raw material costs, manufacturing complexity4, quality requirements, and market conditions5 to determine final pricing.

Comprehensive Methodology for Accurate Steel Price Calculation

Steel price calculation requires systematic analysis of all cost components6. Missing any element leads to significant pricing errors and project budget shortfalls.

Start with the base price for equivalent standard material. This reflects current raw material costs and basic manufacturing expenses. For bulb flats, the base price typically runs 15-25% higher than flat bars due to more complex rolling requirements.

Steel Price Calculation Components:

| Cost Component | Typical Range | Calculation Basis | Variables Affecting Cost |

|---|---|---|---|

| Base Material Cost | $500-$700/ton | Iron ore, coal, scrap | Commodity prices, energy costs |

| Manufacturing Cost | $150-$300/ton | Rolling, labor, utilities | Production efficiency, wage rates |

| Size Premium | $50-$200/ton | Section complexity | Setup time, rolling speed, reject rate |

| Certification Cost | $100-$250/ton | Surveyor fees, testing | Classification society, test frequency |

| Profit Margin | 8%-15% | Business overhead, risk | Competition, order size, payment terms |

| Quantity Discount | 3%-10% | Production efficiency | Order size, repetition, relationship |

Add size-specific premiums for bulb flat dimensions. Larger sections require more powerful equipment and slower rolling speeds. Thicker webs demand higher reduction ratios and more passes. Complex profiles like bulb flats need specialized rolling stands not used for standard sections.

Include certification and testing costs explicitly. ABS certification typically adds $150-$200 per ton for surveyor time, documentation, and witness testing. LR certification runs slightly higher at $180-$250 per ton. Multiple certifications don’t double costs but do add incremental expenses.

Factor in quantity breaks and relationship discounts. Mills offer better pricing for larger orders that optimize production runs. Established customers often receive preferential pricing based on payment history and order consistency. These discounts typically range from 3% for medium orders to 10% for very large contracts.

Consider market conditions5 and price adjustment clauses. Many suppliers include raw material surcharges that adjust with commodity price changes. Currency fluctuation clauses protect against exchange rate movements. Understanding these elements prevents surprise cost increases.

What is the price of 1 ton of steel?

Buyers often receive surprisingly different quotes for one ton of steel from various suppliers. These discrepancies cause confusion and delay purchasing decisions unnecessarily.

The price of 1 ton of steel ranges from $600 for basic construction steel to $3,500 for specialized marine stainless steel. Marine bulb flat steel typically costs $800-$1,800 per ton depending on grade, certification, and purchase quantity. Small orders under 5 tons incur 15-25% premium pricing.

Detailed Breakdown of Single Ton Steel Pricing Components

Single ton pricing differs significantly from bulk pricing due to fixed cost allocation and handling considerations. Understanding these differences helps buyers evaluate quotes realistically.

Minimum order quantity policies affect per-ton pricing dramatically. Mills prefer production runs of 20+ tons for efficiency. Orders under 5 tons incur setup charges, shorter production runs, and higher per-unit fixed cost allocation. This creates the single-ton price premium.

Single Ton vs Bulk Pricing Comparison:

| Cost Element | Single Ton Cost | 20-Ton Cost | Difference Reason | Negotiation Potential |

|---|---|---|---|---|

| Base Material | $650 | $620 | Same commodity cost | None, market driven |

| Rolling Setup | $150 | $15/ton | Fixed cost spread | Limited, technical constraint |

| Certification | $250 | $180/ton | Fixed surveyor fees | Moderate, schedule flexibility |

| Testing | $120 | $80/ton | Batch vs individual | High, test frequency |

| Packaging | $80 | $40/ton | Manual vs automated | Moderate, method choice |

| Profit Margin | 15% | 10% | Risk premium | High, relationship dependent |

Certification costs distribute differently for small quantities. Surveyor fees for ABS or LR certification remain relatively fixed regardless of order size. For a single ton, these fixed costs represent a significant percentage. For larger orders, they distribute across more material.

Testing requirements impact single ton pricing disproportionately. Material certification requires mechanical testing, chemical analysis, and often non-destructive examination. These tests have minimum charges that don’t scale linearly with quantity, hitting small orders harder.

Packaging and handling costs vary by order size. Single tons require special packaging for protection during shipping. Loading and documentation involve similar effort regardless of quantity. These fixed handling costs represent a larger percentage for small orders.

Market positioning and supplier type influence single ton pricing. Traders and stockists typically charge higher per-ton rates but offer faster delivery. Mills prefer larger orders but may accept small quantities at premium prices during slow periods.

What’s the price of steel right now?

Current steel prices change daily, yet many buyers base decisions on outdated price information. This practice leads to budget shortfalls and supplier relationship problems when prices increase unexpectedly.

Current marine bulb flat steel prices range from $850-$1,300 per ton for June 2024 delivery. ABS certified material costs $1,100-$1,500/ton, while LR certified ranges $1,150-$1,600/ton. Prices fluctuate weekly based on raw material costs and demand patterns in shipbuilding markets.

Real-Time Steel Price Analysis and Market Monitoring Strategies

Current steel pricing reflects immediate market conditions rather than long-term trends. Understanding these dynamics helps buyers time purchases optimally and manage price risk effectively.

Raw material price movements drive short-term steel price changes. Iron ore prices above $120/ton indicate strong demand and potential price increases. Coking coal prices above $250/ton suggest continued steel price strength. Scrap steel prices above $400/ton support overall price levels.

Current Market Price Indicators:

| Price Indicator | Current Level | Trend Direction | Impact on Steel Prices | Forecast Period |

|---|---|---|---|---|

| Iron Ore (62% Fe) | $125-135/ton | Rising | Strong upward pressure | 1-2 months |

| Coking Coal | $260-280/ton | Stable | Supportive pricing | 1-3 months |

| Steel Scrap | $380-420/ton | Volatile | Mixed influence | 1-4 weeks |

| Baltic Dry Index | 1,800-2,200 | Rising | Higher shipping costs | Immediate |

| CNY/USD Exchange | 7.10-7.25 | Stable | Neutral for exports | 1-6 months |

Chinese domestic demand significantly influences export pricing. Strong construction activity in China reduces material available for export, increasing prices. Government infrastructure spending announcements often trigger price movements within days as markets anticipate demand changes.

Shipbuilding order books affect marine steel pricing specifically. High newbuilding contracts increase demand for certified marine sections like bulb flats. Order cancellations or delays create temporary surpluses and price opportunities. Monitoring major shipyards’ order intake provides demand signals.

Currency exchange rates impact export pricing competitiveness. The Chinese Yuan exchange rate against the US Dollar directly affects export quotes. A stronger Yuan makes Chinese steel more expensive internationally. A weaker Yuan improves price competitiveness for overseas buyers.

Market monitoring techniques provide price advantage. Subscribe to steel price reporting services like MEPS or SBB. Follow commodity price indices for iron ore and coking coal. Monitor shipping indices for freight cost trends. Track currency exchange rates for potential purchasing opportunities.

Conclusion

Understanding marine bulb flat steel pricing requires analyzing multiple factors beyond basic material costs. Proper price knowledge enables better budgeting and supplier negotiations.

-

Explore this resource to understand the comprehensive methods for accurately calculating steel prices. ↩ ↩ ↩

-

Understanding certification costs is essential for accurate pricing; this resource breaks down the expenses involved. ↩ ↩

-

Discover how quantity discounts can significantly reduce costs for larger orders, benefiting your budget. ↩

-

Learn how manufacturing complexity impacts pricing, which is crucial for project managers to consider. ↩

-

Explore how market conditions can affect steel pricing, helping you anticipate potential cost fluctuations. ↩ ↩

-

This link will provide insights into the various cost components that affect steel pricing, ensuring accurate budgeting. ↩