A single late steel delivery can stop a shipyard’s entire production line, costing millions per day. Managing a global supply chain for marine steel is not just about buying material; it’s about orchestrating a complex, high-stakes flow of certified products across continents, on time, every time.

Effective marine steel supply chain management coordinates the flow of certified material from mills through suppliers to global shipyards. It focuses on key principles like the 5 C’s (Communication, Collaboration, Coordination, Cooperation, Customer Focus) and follows stages from planning to delivery, ensuring quality, timeliness, and cost-efficiency in a high-risk environment.

For a shipyard in Vietnam or Romania, steel is not just an inventory item; it’s the lifeblood of production. A broken link in the chain means idle cranes and workers. Let’s explore the frameworks and practical realities of managing this critical global flow.

What are the 5 C’s of supply chain management?

Your steel supplier is late. Your logistics partner didn’t update you. Your production manager is angry. These failures often stem from a breakdown in basic supply chain principles, not just logistics. The 5 C’s provide a simple but powerful framework to prevent these issues.

The 5 C’s of supply chain management are: Communication, Collaboration, Coordination1, Cooperation2, and Customer Focus3. In marine steel4, this means clear information flow between all parties, working together to solve problems, aligning schedules and documents, sharing risks and benefits fairly, and always prioritizing the shipyard’s production needs as the ultimate goal.

These concepts sound simple, but their absence causes most real-world supply chain failures. In a cross-border, multi-party operation like marine steel supply, executing on these C’s is a daily challenge. Let’s see what each one means in practice.

Applying the 5 C’s to Marine Steel Logistics

The 5 C’s are not just theory. They are actionable behaviors that define the relationship between a shipyard, its steel supplier, and all intermediaries.

1. Communication5 (The Foundation of Trust)

- The Problem: Silent periods, unclear specifications, status blackouts.

- The Practice: Proactive, multi-channel updates. A supplier should communicate production start, inspection completion, shipping documents, and vessel tracking details without being chased. Our client feedback highlights "fast response" and maintained communication speed as a key differentiator. This includes using clear English and providing accessible points of contact.

2. Collaboration6 (Solving Problems Together)

- The Problem: Finger-pointing when issues arise (e.g., a port delay, a customs holdup).

- The Practice: Working as a team. If a mill delay happens, a collaborative supplier doesn’t just say "the mill is late." They work with the mill to expedite, explore alternative sourcing, and propose a revised timeline with solutions to the shipyard.

3. Coordination1 (Orchestrating the Flow)

- The Problem: Materials arrive out of sequence, or documentation is mismatched.

- The Practice: Aligning all moving parts. This means the supplier coordinates the production of plates and sections so they are ready for consolidated shipping. They ensure the Bill of Lading, MTCs, and packing lists all match and are sent to the correct parties (bank, freight forwarder, shipyard) on time.

4. Cooperation2 (Shared Goals and Fairness)

- The Problem: Adversarial relationships focused only on price, leading to hidden costs or quality cuts.

- The Practice: Recognizing mutual success. A cooperative supplier understands that the shipyard’s project success is their own success. They offer fair pricing and are transparent about costs. They cooperate on quality inspection (offering SGS support) because they share the goal of delivering defect-free material.

5. Customer Focus3 (The Ultimate Purpose)

- The Problem: Internal processes of the supplier take priority over the shipyard’s urgent needs.

- The Practice: Every decision is viewed through the lens of the shipyard’s production schedule7. This means offering flexible MOQ8 for project needs, providing customs clearance support to avoid port delays, and packing steel to survive the specific journey to that yard.

How a Supplier’s Failure on the 5 C’s Manifests:

| Failed "C" | Symptom for the Shipyard | Our Mitigation as a Supplier |

|---|---|---|

| Poor Communication5 | "Where is my steel?" No updates for weeks. | Dedicated English-speaking sales rep. Automated tracking updates. |

| Lack of Collaboration6 | "The mill is behind, nothing we can do." | Long-term mill partnerships give us leverage to expedite. We problem-solve. |

| Weak Coordination1 | Plates arrive, but bulb flats are delayed by a month. | Integrated supply: we source and ship complementary products together. |

| Uncooperative Behavior | "SGS inspection is extra and will delay everything." | We offer and facilitate inspection as a standard service option. |

| Internal Focus | "Our payment terms are 100% advance, no exceptions." | We offer flexible terms and work with shipyards on practical payment schedules. |

Mastering these 5 C’s turns a transactional vendor into a strategic supply chain partner. This is the foundation upon which reliable delivery is built.

What are the 7 C’s of supply chain management?

You manage the 5 C’s well, but you still face issues with cost overruns or unreliable suppliers. The expanded 7 C’s framework adds two crucial dimensions that are especially relevant for capital-intensive, global industries like shipbuilding.

The 7 C’s of supply chain management add Cost and Consistency to the original 5. For marine steel, Cost means managing total landed cost, not just unit price. Consistency means reliable, repeatable quality and delivery performance across multiple orders, which is vital for a shipyard’s production planning.

Cost and Consistency are the metrics by which shipyard procurement managers are judged. A supplier might be communicative and cooperative, but if their prices are unpredictable or their quality varies, the partnership fails. Let’s dive into these critical additions.

The Metrics of Success: Cost and Consistency

The 5 C’s are about how you work together. The 7 C’s add what you achieve together.

The 6th C: Cost (Total Cost of Ownership)

In marine steel, "cost" is not the FOB price per ton. It is the Total Landed Cost (TLC)1. TLC includes:

- Unit material cost.

- Inland and ocean freight.

- Insurance.

- Import duties and taxes.

- Cost of delays (inventory holding, production stoppages).

- Cost of quality failure (rework, scrap, repair).

A supplier focused on the Cost C will work to optimize the entire chain to reduce TLC. This might mean:

- Consolidating shipments2 to get better freight rates.

- Providing accurate documentation to prevent customs delays and demurrage charges.

- Ensuring perfect packaging to eliminate damage and replacement costs.

- Offering stable, transparent pricing3 linked to indices to aid budgeting.

The 7th C: Consistency (The Foundation of Trust)

This is perhaps the most important C for a shipyard. Production lines are scheduled months in advance. They need to know that steel will arrive on a specific date, with a specific quality, every single time.

- Consistency in Quality4: The AH36 plate from order #1 must have the same weldability, toughness, and surface condition as order #10. This comes from sourcing from the same certified mills with stable processes.

- Consistency in Delivery: Lead times must be reliable. A promise of "12 weeks" cannot become 18 weeks.

How Inconsistency Disrupts a Shipyard:

| Inconsistent Element | Impact on Shipyard | The Ideal (Consistent) Supplier Behavior |

|---|---|---|

| Variable Chemistry | Welding procedures must be re-qualified for each batch, causing delays. | Sources from mills with tight process control. Provides predictable Carbon Equivalent values. |

| Unpredictable Lead Times | Production planners cannot trust schedules. Buffer stock costs rise. | Provides realistic lead times based on fixed mill slots and maintains them. |

| Fluctuating Surface Finish | Some batches are clean, others have heavy scale, disrupting coating schedules. | Enforces strict surface quality standards and inspection before shipment. |

| Erratic Communication | Sometimes fast replies, sometimes radio silence. Creates anxiety. | Maintains a standard communication protocol and response time (like our 2-hour response benchmark). |

Our business model is engineered for these two C’s. Our long-term cooperation with certified mills5 ensures Consistency in quality and supply. Our competitive factory price and shipping support aim to optimize the Total Landed Cost. Client feedback mentioning "stable quality" and "best packaging" is direct evidence of success in delivering Consistency and managing Cost (by preventing damage-related costs).

What is the supply chain in the marine industry?

You see a finished ship. The supply chain that built it is invisible but immense. It’s a global network that moves thousands of components, with marine steel being the largest and most fundamental. A delay in any part can ripple through the entire project.

The marine industry supply chain is the global network that designs, sources, manufactures, and delivers all materials and components needed to build, repair, and operate ships and offshore structures. For shipbuilding, it is a project-based, engineered-to-order1 chain, starting with raw materials (like steel plates) and ending with complex systems (engines, navigation) installed on the vessel.

This chain is uniquely complex. It’s not like retail where you restock the same items. Each ship is a one-off project with a custom bill of materials. The steel supply chain is the first and most critical link in this wider network. Let’s map it out.

Mapping the Ecosystem: From Ore to Offshore

The marine steel supply chain2 sits within a much larger ecosystem. Understanding your position in this ecosystem helps you manage dependencies and risks.

The Extended Marine Supply Chain (Simplified):

- Raw Material Suppliers: Iron ore mines, coking coal producers, scrap metal dealers.

- Primary Producers: Steel Mills (Integrated & Mini-mills). They produce slabs, plates, coils, and sections.

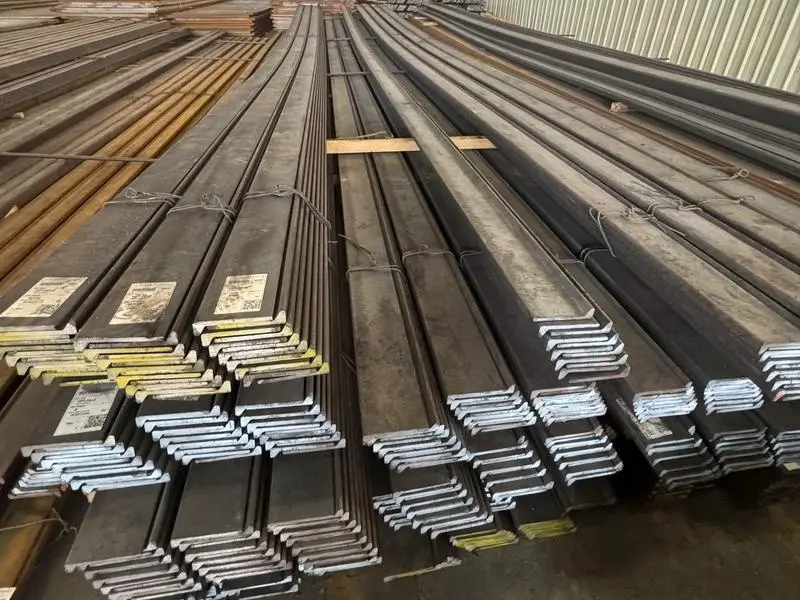

- Secondary Processors & Stockists: Service centers that cut, blast, prime, or otherwise process steel. Also, specialized suppliers of marine steel (our role).

- Shipyards & Fabricators: The customers. They cut, weld, and assemble the steel into hulls, blocks, and structures.

- System Integrators & OEMs: Suppliers of engines, propellers, electrical systems, etc. They also depend on steel for their own fabrications.

- Classification Societies & Inspectors: (ABS, DNV, LR, etc.) They certify materials and processes at various stages, acting as quality gatekeepers.

- Logistics Providers: Freight forwarders, shipping lines, trucking companies that move everything.

The "Engineered-to-Order" Challenge:

Unlike the automotive industry, you cannot build a ship from a standard inventory. The supply chain is activated by a specific ship contract.

- The Trigger: A shipyard wins a contract to build a 10,000 TEU container ship.

- The Cascade: Naval architects create detailed drawings. The Bill of Materials (BOM)3 is generated, listing every piece of steel by grade, thickness, and shape.

- The Procurement: The steel BOM is sent to suppliers like us. We then engage with mills to produce or allocate the specific grades and dimensions.

Vulnerabilities in the Marine Steel Link:

- Long Lead Times: Mill production for specific marine grades can take 8-12 weeks.

- Certification Bottlenecks: Class society surveyor availability for witnessing tests can delay MTC issuance.

- Geopolitical & Trade Issues: Tariffs, sanctions, or port closures can disrupt flows.

- Demand Volatility: When shipbuilding booms, mill capacity becomes scarce, and prices rise.

The Role of a Specialized Marine Steel Supplier:

In this complex chain, we act as a critical intermediary and risk manager for the shipyard.

- We Aggregate Demand: We combine orders from multiple yards to achieve mill MOQs and secure production slots.

- We Manage Certification: We ensure the mill’s process is aligned with class rules and that MTCs are properly issued.

- We Simplify Logistics: We turn a complex BOM into a few consolidated shipments.

- We Provide Certainty: We give the yard a single point of contact and accountability for the most massive material input.

For a shipyard, partnering with a supplier who deeply understands this ecosystem is not a luxury; it’s a necessity for keeping the project on schedule.

What are the 5 stages of supply chain management?

You need a framework to manage your steel procurement systematically. Reacting to problems is costly. The 5 stages of SCM provide a proactive cycle to plan, source, make, deliver, and return goods. For steel, the "Make" stage happens at the mill, but the other four are in your control.

The 5 stages of supply chain management form the SCOR model1 (Plan, Source, Make, Deliver, Return). For a shipyard procuring marine steel: Plan the material needs from drawings; Source from certified mills/suppliers; the mill Makes the steel; the supplier Delivers it to the yard; and Return involves handling rejected material or excess scrap. Effective management of these stages ensures a smooth flow.

This model is a universal blueprint. Applying it specifically to marine steel procurement reveals the critical tasks and decision points at each stage. It turns ad-hoc buying into a managed business process.

The SCOR Model in Action: A Shipyard’s Guide

Let’s walk through each stage from the perspective of a shipyard procurement manager, and see how a supplier partner fits in.

Stage 1: PLAN (The Foundation)

- Shipyard’s Task: This is the most important stage. Based on the ship design, create an accurate Master Material List2 and a procurement schedule3 that aligns with the production block assembly plan. Determine required quantities, grades, and delivery dates for plates, sections, etc.

- Supplier’s Support Role: A good supplier can provide technical input4 during planning, advising on standard sizes to minimize waste or suggesting equivalent grades. They can also give realistic lead time estimates for different products to inform the schedule.

Stage 2: SOURCE (The Selection)

- Shipyard’s Task: Select and contract with suppliers. This involves RFQs, negotiation, and placing purchase orders. The key is selecting suppliers who can meet the plan (quality, quantity, time).

- Supplier’s Role (Our Core): This is where we engage. We respond with detailed quotes, provide mill certifications, and agree on terms. Our value is proven through stable quality, fast response, and support services like inspection—directly addressing the pain points of our typical customers.

Stage 3: MAKE (The Production)

- Shipyard’s Task: For steel, this stage is outsourced to the mill. The shipyard’s task is monitoring and quality assurance.

- Supplier’s Role: We manage this stage on your behalf. We place the order with the mill, monitor production, and arrange pre-shipment inspection (SGS)5. We act as your remote quality control agent at the production site.

Stage 4: DELIVER (The Execution)

- Shipyard’s Task: Receive the goods, handle import customs, transport to the yard, inspect upon receipt, and store.

- Supplier’s Role: We execute logistics: booking shipping, preparing export docs, and tracking the shipment. We can provide delivery terms like CIF or DAP6 to simplify the process for the yard. Good packaging (as noted by our clients) ensures the steel arrives in a deliverable condition.

Stage 5: RETURN (The Loop Closure)

- Shipyard’s Task: Handle any non-conforming material (e.g., steel that fails receipt inspection) and manage steel scrap from cutting.

- Supplier’s Role: A reliable supplier has a clear process for handling quality claims7, including investigation and replacement. While scrap is usually the yard’s responsibility, a supplier can sometimes advise on or facilitate scrap resale.

How Problems Cascade Through the Stages:

| Failure in Stage | Consequence for Later Stages | Example in Marine Steel |

|---|---|---|

| Poor PLANning (Wrong quantities/dates) | Chaos in SOURCE and DELIVER. | Ordering plates too late delays hull assembly. Emergency air freight may be needed. |

| Poor SOURCEing (Choosing a bad supplier) | Failure in MAKE and DELIVER. | Supplier provides uncertified steel. It gets rejected at delivery, stopping production. |

| Failure in MAKE (Mill quality issue) | Crisis in DELIVER and RETURN. | Steel arrives with incorrect chemistry. It must be returned, causing a major delay. |

| Failure in DELIVER (Logistics damage) | Immediate problem in RETURN. | Bundles broken, steel bent during shipping. Material is unusable and must be replaced. |

By understanding and actively managing these five stages, a shipyard transforms its steel procurement from a reactive cost center into a strategic, reliable component of production. A supplier who is aligned with this model becomes an extension of the shipyard’s own supply chain team.

Conclusion

Managing the marine steel supply chain for global shipyards requires applying core principles like the 5C’s/7C’s, understanding the unique project-based marine ecosystem, and systematically executing the five stages of SCM from planning to delivery.

-

Explore the SCOR model to understand its significance in optimizing supply chain processes. ↩ ↩ ↩ ↩ ↩ ↩

-

Learn about the Master Material List to enhance your procurement planning and efficiency. ↩ ↩ ↩ ↩ ↩

-

Learn how to create a procurement schedule to align material needs with production timelines. ↩ ↩ ↩ ↩ ↩

-

Discover how technical input can improve procurement decisions and reduce waste. ↩ ↩ ↩

-

Understand the role of pre-shipment inspection in ensuring product quality before delivery. ↩ ↩ ↩ ↩

-

Get insights into CIF and DAP terms to streamline your shipping and logistics processes. ↩ ↩ ↩

-

Explore effective strategies for managing quality claims to maintain supplier relationships. ↩ ↩

-

Learning about flexible MOQ can help adapt to varying project demands and improve service. ↩