Ever placed an order for marine steel, only to face delays, quality surprises, and communication headaches? You’re not alone. The journey of sourcing from China is full of promise but also paved with specific hurdles. Let me share the realities from our side of the ocean, as someone who lives and breathes this trade every day.

Many buyers face five main challenges: ensuring consistent quality standards, navigating complex logistics and lead times, overcoming communication and cultural gaps, verifying supplier reliability and certifications, and managing price versus performance trade-offs. A strategic approach with clear communication is key to success.

As someone deeply embedded in China’s steel industry, I see these challenges play out daily—not just for my clients, but in the entire market ecosystem. Understanding them isn’t about discouraging trade; it’s about building a smarter, more resilient partnership. The following sections break down the core issues, separating common myths from on-the-ground facts, to help you navigate your next purchase with confidence.

What are the issues with Chinese steel?

You might have heard stories about steel that doesn’t meet spec, or worse, fails prematurely. The fear is real. For a project manager staking their reputation on material integrity, inconsistent quality is a nightmare scenario that can halt production and blow budgets.

The main issues often cited with Chinese steel revolve around variable quality control, differing interpretations of international standards, and inconsistent material certifications. However, these are not universal and are heavily dependent on the specific mill and the supplier’s oversight. Partnering with a qualified supplier who understands international requirements is crucial to mitigate these risks.

Breaking Down the Quality Perception Gap

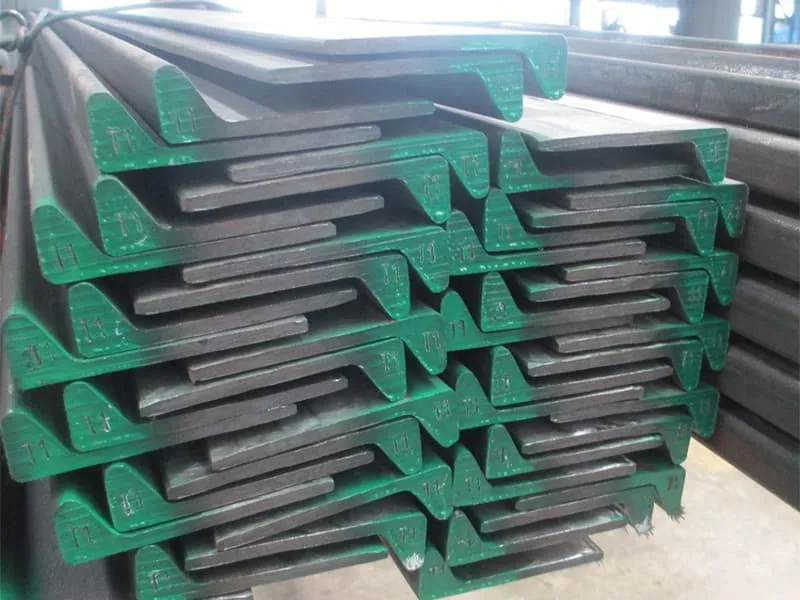

Let’s be clear: China produces some of the world’s best and, unfortunately, some lower-grade steel. The "issue" is not a monolith but a spectrum largely defined by the factory’s capabilities, the buyer’s specifications, and the supplier’s role as a gatekeeper.

The core problem for many international buyers is a "perception gap." They see "Chinese steel" as one category, but the reality is a vast hierarchy. A massive, state-of-the-art mill supplying global shipyards operates on a completely different level than a smaller factory catering to domestic, price-sensitive markets. When a buyer prioritizes the lowest price above all else, they often, unknowingly, select from the latter tier.

From my desk at CNMarineSteel, the most common quality disputes we mediate stem from three areas:

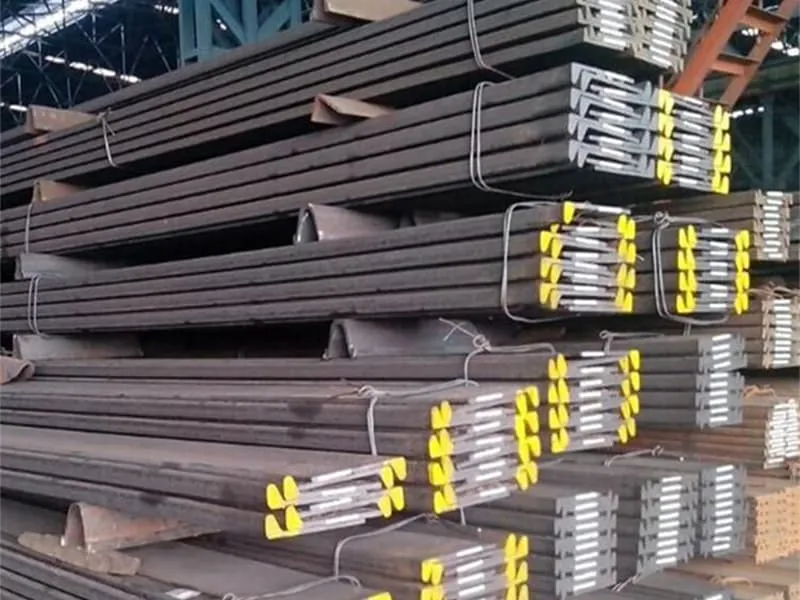

- Surface Finish and Dimensional Tolerances: International standards like ASTM or EN have strict tolerances for flatness, thickness, and surface defects (like pitting or scaling). Some mills, especially those without significant export experience, may apply looser domestic standards (GB standards), leading to material that is technically "steel" but not fit for precise marine fabrication.

- Chemical Composition and Mechanical Properties: The certificate is everything. We’ve seen cases where a Mill Test Certificate (MTC) shows values within range, but third-party inspection reveals slight deviations in elements like sulfur or phosphorus, or lower-than-expected impact toughness at low temperatures. This isn’t always malice; sometimes it’s process variability. The solution is insisting on SGS or equivalent inspection before shipment, not after.

- Packaging and Handling: Quality isn’t just about the steel’s chemistry; it’s about delivering it intact. Inadequate packaging for sea voyage can lead to edge damage or severe rust, turning A-grade material into a site problem. This is a logistical oversight that speaks volumes about a supplier’s experience.

Here’s a simple comparison we use to explain the landscape to new clients:

| Supplier Type | Typical Quality Risk | Who They Sell To | Key Differentiator |

|---|---|---|---|

| Direct from Top-Tier Mills | Very Low | Major global OEMs, State Projects | Advanced facilities, in-house R&D, consistent high-volume output. |

| Professional Export Agents (Like Us) | Managed & Low | International distributors, project contractors. | Supplier vetting, pre-shipment QC, standard alignment, logistics expertise. |

| Trading Companies (No Oversight) | High & Unmanaged | Buyers focused solely on lowest price. | Little to no quality control; act as order-passers. |

| Direct from Smaller/Uncertified Mills | Very High | Domestic market or uninformed buyers. | Variable processes, outdated equipment, no export experience. |

The takeaway? The "issue" is manageable. It requires moving beyond a price-only conversation. You must ask: What specific mill will produce my steel? Can I see their certifications? What is your procedure for verifying the MTC? Can you support a third-party inspection? A supplier’s answers to these questions reveal their commitment to being part of the quality solution, not the problem.

What are the challenges of the steel industry?

Imagine running a business where your raw material costs swing wildly, and government policies can change your entire operating landscape overnight. This is the daily reality for steel mills in China, and these upstream challenges inevitably ripple down to you, the buyer.

The global steel industry faces significant challenges including overcapacity, stringent environmental regulations pushing for "green steel1," volatile prices for raw materials like iron ore and coking coal, and the need for massive technological upgrades. These factors create a complex and sometimes unpredictable supply environment.

The Forces Shaping Your Supply Chain

To source wisely, you need to understand the pressures on your supplier’s suppliers—the mills. The challenges here are macroeconomic and policy-driven, and they directly affect lead times, costs, and availability.

First, let’s talk about environmental policy2. China’s "dual carbon" goals (peak carbon by 2030, carbon neutrality by 2060) are not just slogans. They are enforced through strict production curbs, especially in northern provinces during winter to combat pollution. A mill we work with in Hebei might have its output arbitrarily reduced by 30% for a quarter. This doesn’t mean it shuts down; it means it prioritizes its largest, longest-term contracts. If you’re a new or small-volume buyer, your order can be delayed unexpectedly. A reliable supplier monitors these policies and diversifies its mill partnerships across different regions to mitigate this risk.

Second, extreme raw material volatility3. Iron ore prices are set globally, and coking coal supplies can be disrupted. When these costs spike, mills are quick to raise their prices. The quotes you receive can have very short validity periods—sometimes just 24-48 hours. This is frustrating but reflects their own cost uncertainty. We see this as a communication test. A good supplier explains these market movements transparently instead of just sending a new, higher price without context.

Third, the push for technological transformation and overcapacity4. China has massive steel capacity. The government is actively consolidating the industry, shutting down old, polluting blast furnaces and encouraging electric arc furnaces (which use scrap steel). This "green transition" is necessary but costly. Mills are investing billions, and these costs are factored into future pricing. Meanwhile, the existence of overcapacity means competition is fierce, which can benefit buyers on price but also pushes some less scrupulous players to cut corners.

Finally, energy supply and cost5. Steelmaking is energy-intensive. Fluctuations in coal and electricity prices, or sudden power rationing directives, can disrupt production schedules without warning.

For you, the buyer, these industry challenges translate into a few clear imperatives:

- Build a relationship, not just a transaction. A supplier who sees you as a partner is more likely to fight to allocate capacity to you during tight periods.

- Understand price drivers. Ask, "Is this price change due to raw materials or mill policy?" It shows you’re an informed partner.

- Plan for flexibility. In a volatile market, rigid just-in-time schedules are risky. Building buffer time into your project planning is prudent.

What are the disadvantages of trading with China?

Beyond the product itself, the act of doing business across 8,000 kilometers and a significant cultural divide presents its own set of tests. Time zone differences alone can stretch a simple question into a 48-hour ordeal.

Key disadvantages include significant time zone differences hindering real-time communication, complex logistics and customs procedures, potential intellectual property concerns, navigating cultural and business practice differences, and the challenge of building trust remotely without face-to-face interaction. These hurdles demand extra management effort and patience.

Navigating the Practical Hurdles of Cross-Border Commerce

The disadvantages are real, but they are also predictable and, with the right approach, manageable. They fall into two buckets: operational friction and relational gaps.

On the operational side, logistics is the giant. Shipping marine steel is not like sending a parcel. It involves booking space on a vessel (which can be scarce during peak seasons), preparing a mountain of documents (Commercial Invoice, Packing List, Bill of Lading, Certificate of Origin, Mill Certificates), and navigating the import customs of your country. A small error in the HS code description on the documents can cause your shipment to be held at the destination port, incurring daily demurrage charges that erase any savings on the steel price. Many suppliers expect the buyer to handle destination customs. We learned early on that offering DAP (Delivered at Place) terms to key ports like Dammam or Hai Phong is a major differentiator—it solves a huge pain point for clients like Gulf Metal Solutions.

Communication friction is another major disadvantage. The 12-16 hour time difference means your workday ends as ours begins. Without a dedicated contact, you’re stuck in an email chain with delayed replies. Then there’s the language barrier. Technical specifications for marine steel are complex. Misunderstandings over terms like "normalized" vs. "thermomechanically rolled" can lead to receiving the wrong material. This is why we insist on having fluent English-speaking project managers. As our client from Saudi Arabia noted, the rapid and clear response was their primary reason for choosing us over others.

The relational and cultural gap is subtler but critical. Western business culture often values directness and speed. In China, relationship (guanxi) and face (mianzi) are paramount. Pushing too hard for a discount in the first conversation can shut down trust. Disagreeing bluntly in a group chat can cause your contact to lose face. The business pace can also feel different; decisions might require more internal consultation. The disadvantage is that this process can seem opaque and slow to an outsider.

However, viewing these as permanent disadvantages is a mistake. They are simply the cost of entry into a vast market. The solution is to partner with a supplier that acts as your cultural and operational bridge—one that not only speaks your language but understands your business tempo and takes ownership of the logistical complexity, turning these disadvantages into a managed, predictable part of the process.

What challenges does China face in supplying its future energy needs?

This question might seem off-topic for a steel buyer, but it’s absolutely critical. Steel is the backbone of energy infrastructure—from wind turbine towers to LNG carrier hulls to pipelines. China’s own energy scramble will directly compete for the same high-grade steel you need for your ships.

China’s future energy supply is challenged by a heavy reliance on imported fossil fuels (oil, gas), the need to balance energy security with green transition goals, geographical imbalances between energy sources and demand centers, and the monumental task of building a modern, resilient national grid to support renewable integration.

How National Energy Security Impacts Your Steel Order

China is the world’s largest energy consumer and importer. Its strategy to secure future needs is a two-pronged approach: aggressively build out domestic renewable capacity (solar, wind, nuclear) while locking in long-term fossil fuel imports via global partnerships. Both prongs are massively steel-intensive.

Consider the physical projects. Building thousands of kilometers of new ultra-high-voltage power lines to bring wind power from the Gobi Desert to coastal cities requires immense amounts of steel tower structures. Fabricating the colossal hulls for a new fleet of LNG tankers to import gas from Qatar and Australia demands the highest grades of cryogenic steel. These are national priority projects. When the government places an order, mills allocate their best production lines and highest-quality slabs to fulfill it. This creates competition for premium steel capacity. The marine-grade steel you need for a container ship (like AH36/DH36) is similar in specification and performance to that used in critical energy infrastructure.

This leads to several tangible challenges for an international buyer:

- Priority Shifting: During a push to complete a major energy project, your order for 500 tons of ship plate might be deprioritized at the mill level if you are buying through a low-influence trader. Your lead time gets extended without a clear explanation from your supplier, who may not even be aware of the competing national order.

- Price Pressure: High demand from the energy sector can drive up the base price of specific steel grades and dimensions, making your project budget suddenly tight.

- Quality Focus Drain: A mill’s top metallurgists and quality managers will be focused on the technically demanding energy projects. While your order will still be to standard, the extra margin of care might be diverted.

So, what can you do? This is where a supplier’s market intelligence and mill relationships become priceless. We are constantly talking to our mill partners, not just about our orders, but about their overall order book and national trends. We can see these capacity crunches coming. For our clients, this means we can provide early warnings about potential delays, suggest alternative but technically equivalent grades that are less in demand, or leverage our long-term contract volumes to secure your allocation in advance.

Understanding this macro picture transforms you from a passive price-taker into an informed strategist. It highlights why choosing a supplier who is deeply connected, not just a website with a price list, is essential for securing not just a good deal, but reliable supply in a competitive global market.

Conclusion

Sourcing marine steel from China is a journey of managed complexity. By understanding the true nature of quality control, industry pressures, trade logistics, and macro-energy demands, you can transform potential challenges into a strategic, cost-effective partnership.

-

Learning about green steel initiatives can help you align with sustainable practices and meet regulatory demands. ↩

-

Understanding environmental policies can help you navigate the complexities of sourcing steel and ensure compliance. ↩

-

Exploring this topic will provide insights into pricing strategies and risk management in steel procurement. ↩

-

This resource will shed light on how innovation can reshape the steel market and improve sustainability. ↩

-

Understanding energy dynamics is crucial for anticipating production challenges and pricing fluctuations. ↩